Charlotte Real Estate Market Update

Is 2024 the time to buy?

Charlotte Real Estate Market Update

As a real estate agent deeply ingrained in the Charlotte market, I’ve delved into the latest insights provided by the Charlotte Business Journal, which have been meticulously derived from Canopy MLS data. These findings shed light on the shifting dynamics within our local housing landscape, offering valuable perspective for both buyers and sellers alike.

The analysis encompasses a comprehensive range of residential properties, including single-family homes, condominiums, and townhouses. To provide a holistic view, the data not only examines year-over-year changes but also incorporates pre-pandemic figures from 2019, allowing for a more nuanced comparison.

Before delving into the specifics, it’s worth noting that one ZIP code, 28104, has been excluded from the analysis. This decision stems from its limited geographical presence within Mecklenburg County, coupled with the relatively modest number of home sales—less than 100—in 2023.

Which Charlotte zipcode saw the biggest decline?

Among the standout revelations, ZIP code 28203 emerges with the most significant year-over-year decrease. This area, encompassing the upscale neighborhoods of South End and Dilworth, experienced a notable 36.8% decline in sales, dropping from 302 in 2022 to 191 in 2023. Moreover, sales in 28203 plummeted by 42.5% compared to pre-pandemic levels in 2019.

Following closely behind are ZIP codes 28078 and 28202, both witnessing a substantial 36.7% decline in sales. In the vibrant community of Huntersville (28078), home sales decreased from 1,456 in 2022 to 922 in 2023. Meanwhile, uptown’s 28202 saw sales dwindle from 362 to 229 during the same period.

Additional ZIP codes experienced declines of at least 30%, including 28217 in southwest Charlotte and 28204 in the Elizabeth area. Notably, 28217 stands out as the lone ZIP code in Mecklenburg County to buck the trend, witnessing a remarkable 31.9% increase in home sales compared to 2019.

In terms of overall sales volume, ZIP code 28269, situated north of center city toward Highland Creek, claimed the top spot with 1,138 closings in 2023—the only ZIP code in Mecklenburg County to surpass the 1,000 mark. Conversely, 28204 recorded the fewest closings at 120.

These findings underscore the broader narrative of a cooling housing market in 2023, characterized by constrained inventory and escalating affordability challenges attributed to rising interest rates and sustained price appreciation over the years.

Across the Charlotte region, home sales dipped by 17.3% in 2023, falling to 41,546 closings from 50,222 in the preceding year—a notable departure from the 50,854 sales recorded in 2019. In Mecklenburg County specifically, there were 15,326 closings, marking a substantial 20% decline from 2022 and a significant 26.4% decrease from 2019.

For a detailed visual representation of how home sales fared across Mecklenburg County in 2023 compared to both 2022 and 2019, refer to the accompanying infographic below. This comprehensive breakdown, organized by ZIP code and sorted in descending order of percentage decrease, offers valuable insights into the evolving dynamics of our local real estate landscape.

Charlotte Buyers – Real Estate 2024

What does this mean to you? Since rates have slowly started to drop we have seen buyers come out of the woodwork to prepare to try to buy a home again. Experts are saying between now and the beginning of April you can take advantage of incentives, less chance of bidding wars, and negotiate other terms.

Charlotte buyers love screen porches

“Just-Right” Charlotte Homes beating the stats

- Move-in Ready

- Great schools/location

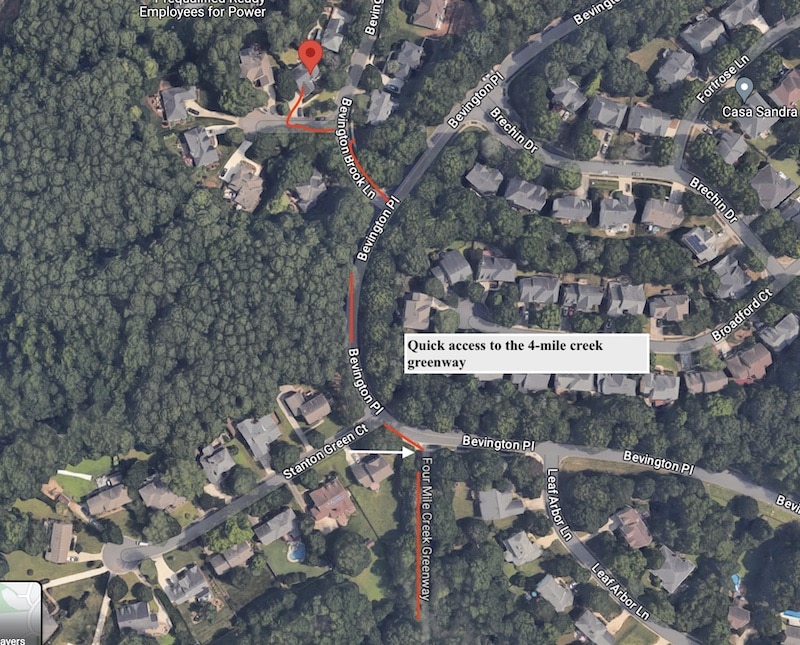

- Close to greenway

- Offering closings costs for rate buy-down

- Screen porch, End-Unit, Pool, Cul De Sac

- New/Like new HVAC, Roof, Windows, Siding

Charlotte Homes that are not winning

- Homes that are outdated

- Topography issues

- Road Noise

- Less desirable schools

- Neglected repairs

- Cost of updates both cosmetic and mechanical not considered when listed

Charlotte’s real estate market in 2024 is going to be a game changer. No longer can you just put your home on the market and sit back and watch the money roll in. Top experts are saying this is the year our value will stand out more than ever.

Got real estate questions? Let’s talk!

Top Charlotte Real Estate Agent

Charlotte Real Estate Agent

Danielle Edwards

danielleedwards@REMAX.net

704-604-2999

Information by Jenna Martin and Canopy MLS.

Are you looking for a classic family house in the center of Charlotte? You need look no further than this gorgeous two-story home, constructed in 1995. It has the ideal balance of traditional beauty and contemporary comfort. For families wishing to make Charlotte their permanent residence, this property is a dream come true with its four roomy bedrooms.

Are you looking for a classic family house in the center of Charlotte? You need look no further than this gorgeous two-story home, constructed in 1995. It has the ideal balance of traditional beauty and contemporary comfort. For families wishing to make Charlotte their permanent residence, this property is a dream come true with its four roomy bedrooms.

by Charlotte Realtor- Danielle Edwards

by Charlotte Realtor- Danielle Edwards