What’s Really Happening in Charlotte’s Real Estate Market?

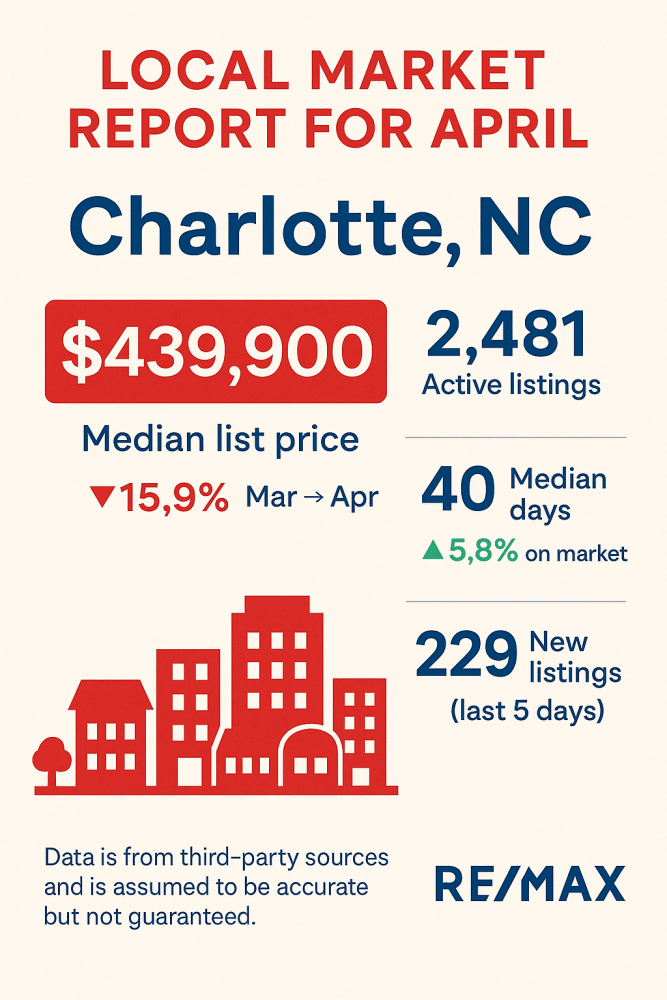

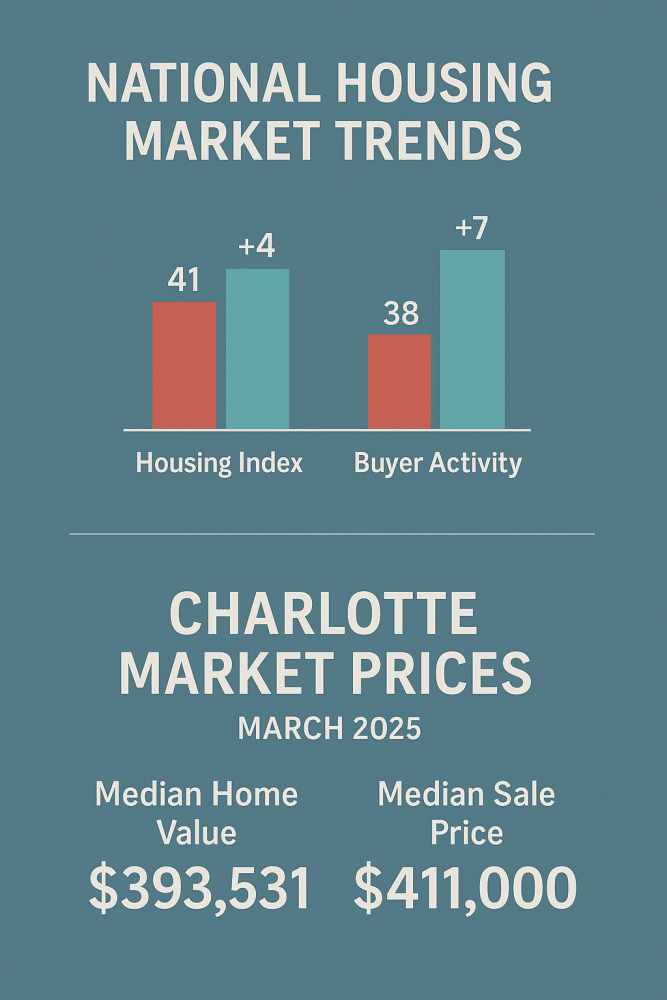

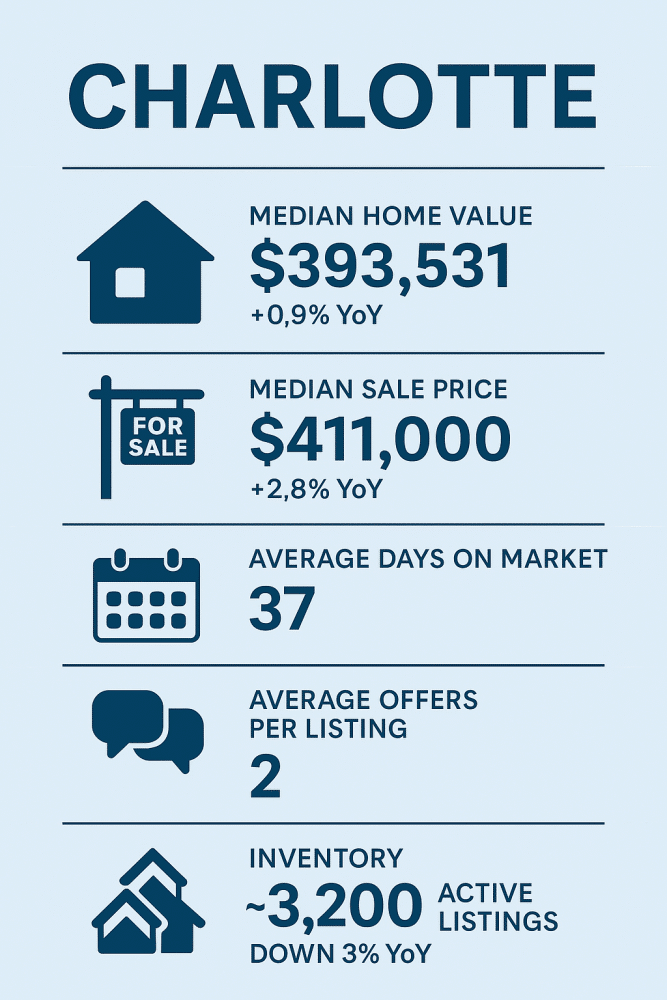

The Charlotte Real Estate Market Update April 2025 reveals a shift that matters to both buyers and sellers. This month’s numbers show a significant change in pricing and inventory, signaling a more competitive landscape.

The median list price has dropped to $439,900, a sharp 15.9% decrease from March. Meanwhile, inventory has grown to 2,481 active listings, a 5.8% month-over-month increase. Even more telling—229 new listings hit the market in just the past five days.

What the Numbers Mean for You

For Buyers

With inventory on the rise, buyers now have more options—and more negotiating power. However, homes in sought-after neighborhoods like South End, Steele Creek, and Plaza Midwood are still drawing attention. Move-in-ready homes continue to attract multiple offers, so acting quickly on the right property remains essential.

For Sellers

Increased competition means presentation and pricing are key. Homes with updated features, energy-efficient systems, and great curb appeal have a distinct edge. This is not the time to overprice or delay staging—buyers are watching closely, and the best homes still go fast.

Market Stability: Days on Market & Local Trends

The median days on market remains steady at 40 days, showing that properties are still moving at a healthy pace. However, with more homes available, it’s critical to make yours stand out.

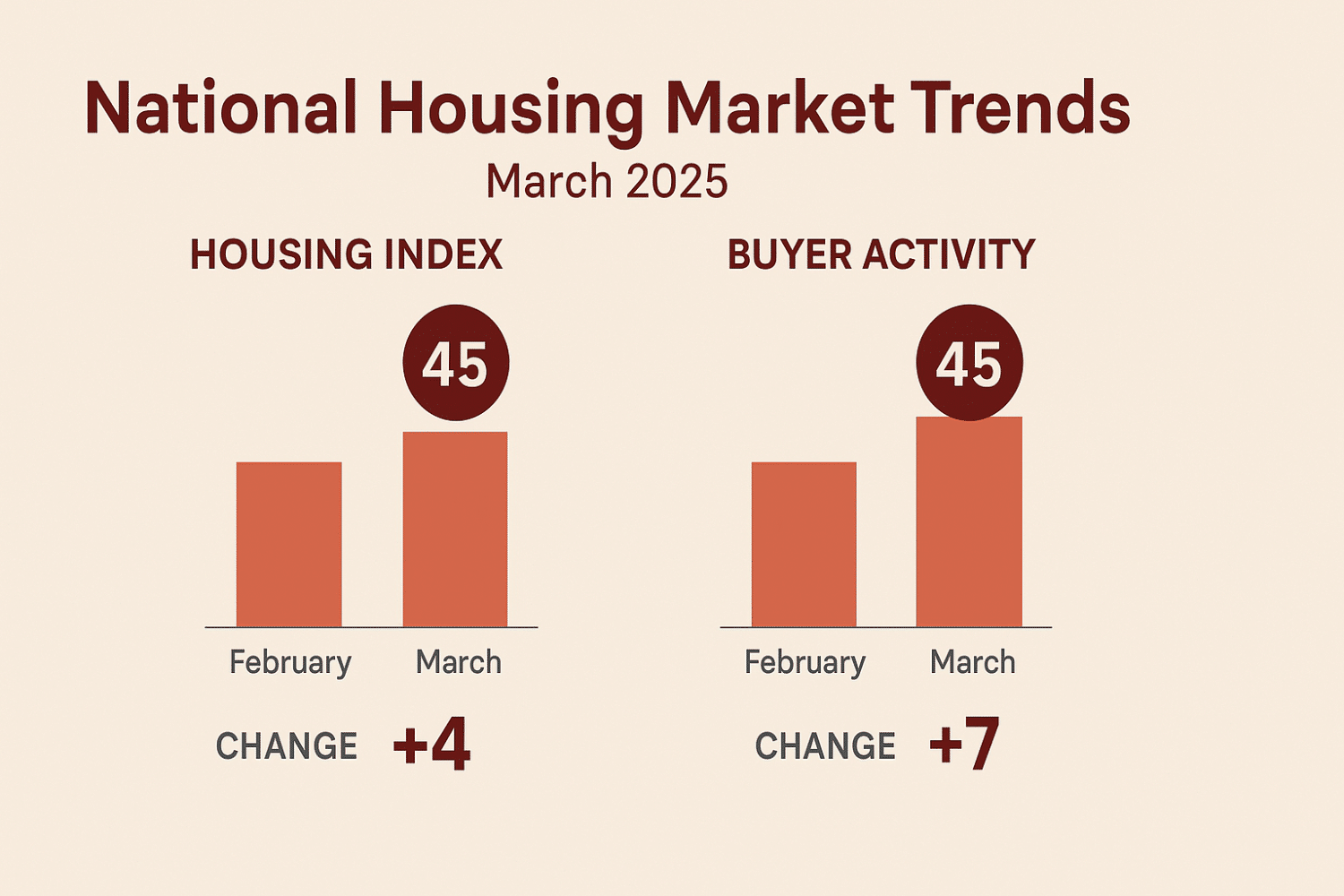

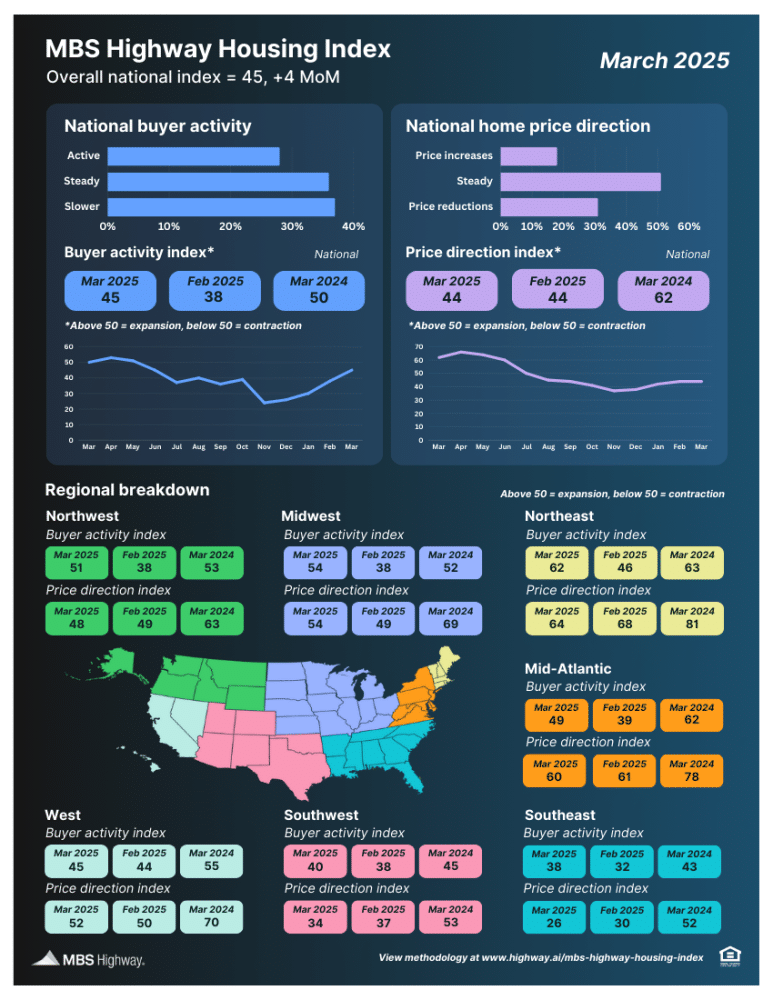

️ Economic Factors Still Driving Demand

Charlotte’s strong job market and continued population growth continue to support demand, but rising interest rates and construction costs are putting pressure on affordability. These factors are influencing not just what people can buy—but how quickly they need to decide.

Ready to Take the Next Step?

Whether you’re a first-time buyer, a seller preparing to list, or just keeping an eye on the market, understanding these shifts helps you make smarter, more confident decisions.

Ready to talk strategy? Let’s connect and make your next move count.

.

.

.

.

Top Charlotte Real Estate Agent As Seen on House Hunters Charlotte guiding her buyer, Lyndsay, on her relocation. info@soldondanielle.com | 704-604-2999 | Charlotte Real Estate Agent | Selling Charlotte since 2006 | Visit my YouTube Testimonials