Is 2024 a Good Time to Buy a House? Key Market Insights

If you’re asking yourself, “Is 2024 a good time to buy a house?” you’re not alone. Many potential homebuyers are curious about what this year holds for the housing market.

Current Housing Market Trends

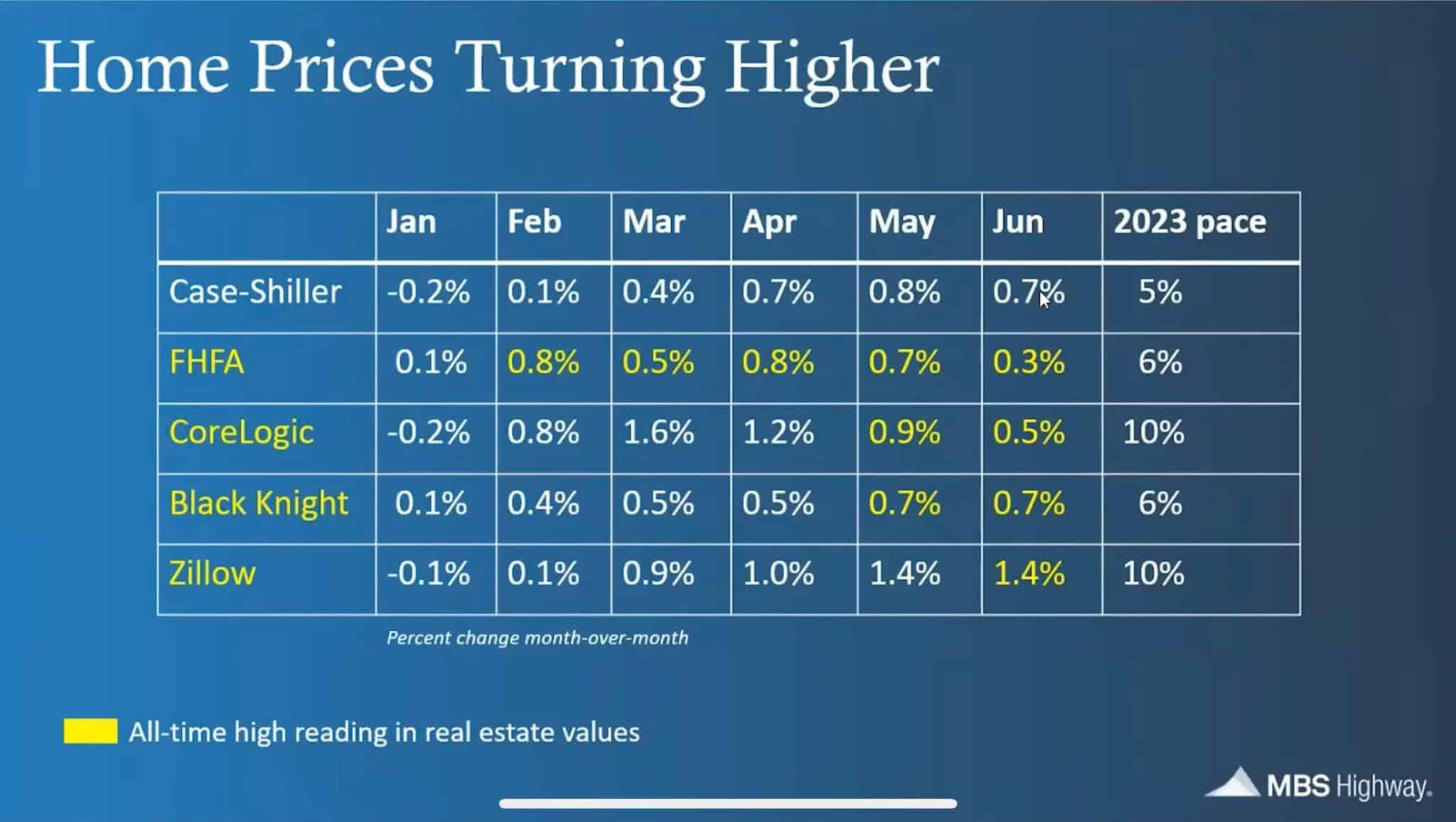

The real estate market in 2024 is showing signs of change. Here are some key trends to consider:

- Increased Inventory: More homes are becoming available, giving buyers more options to choose from.

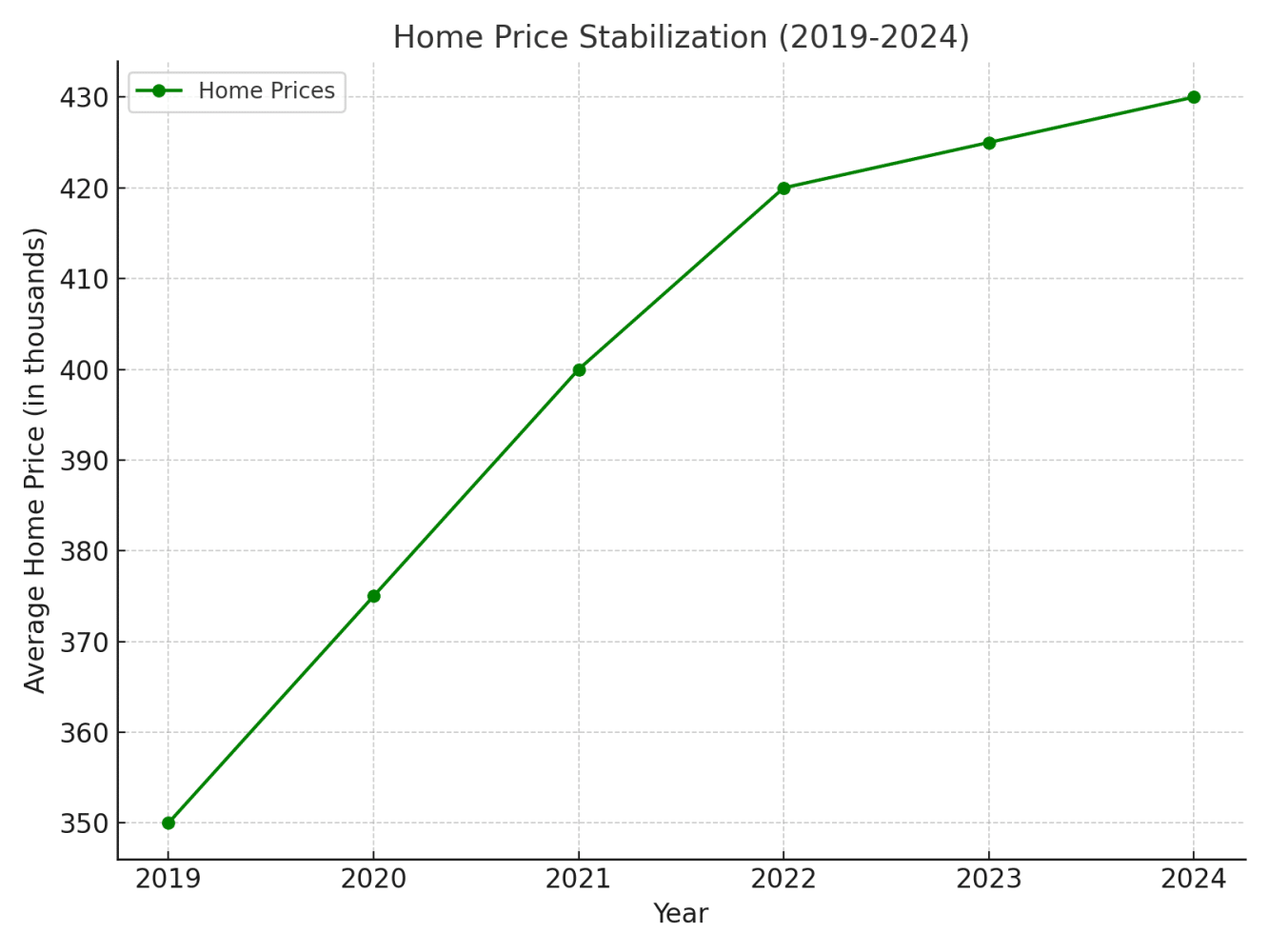

- Stabilizing Prices: Home prices are leveling off after years of rapid growth, potentially making purchases more affordable.

The graph above shows how average home prices have started to stabilize from 2019 to 2024, indicating a less volatile market for potential buyers.

Interest and Mortgage Rates

Interest rates play a significant role in determining whether it’s a good time to buy:

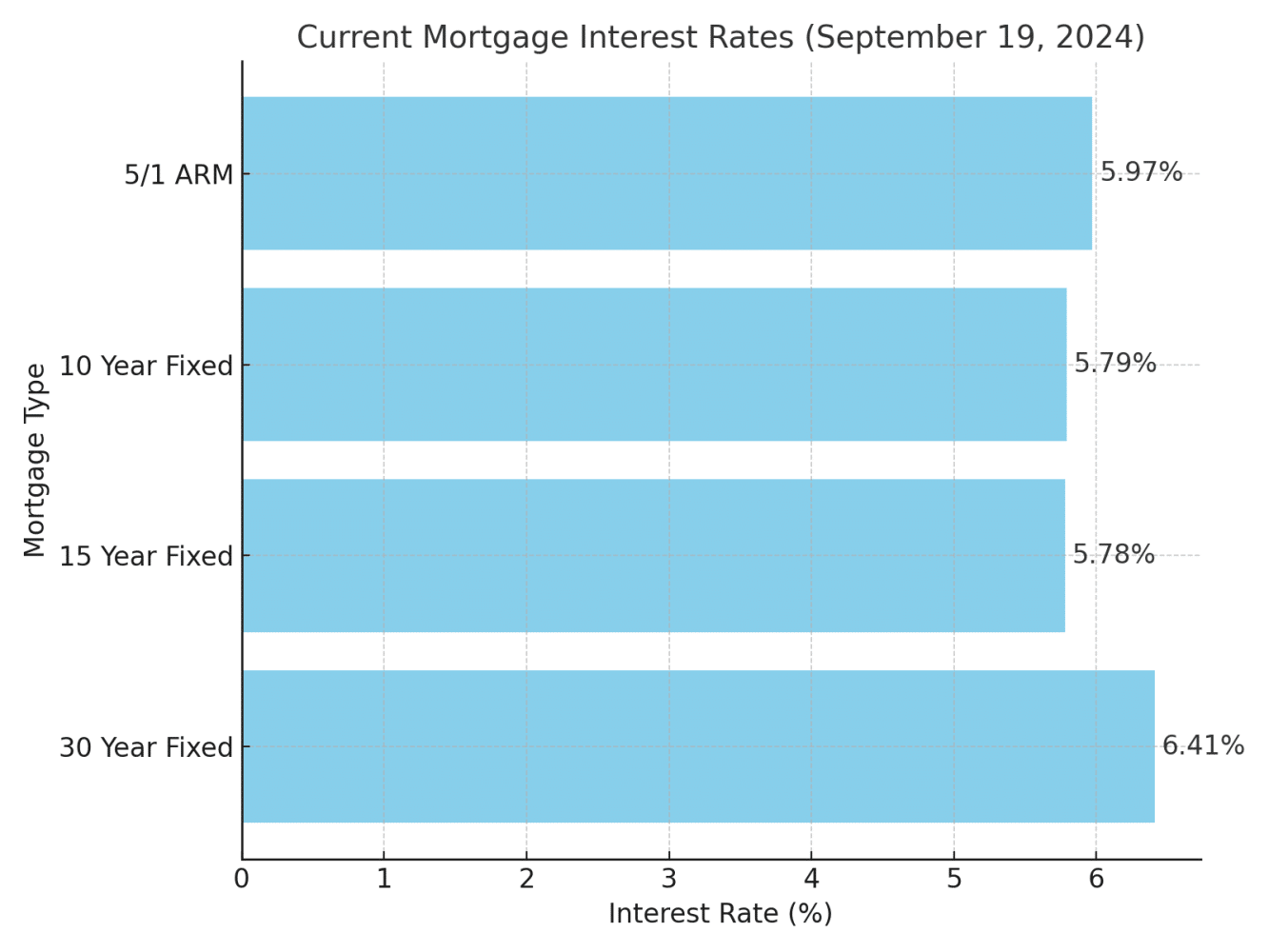

- Potential Rate Drops: Economists predict that mortgage rates may decrease, lowering monthly payments for new buyers.

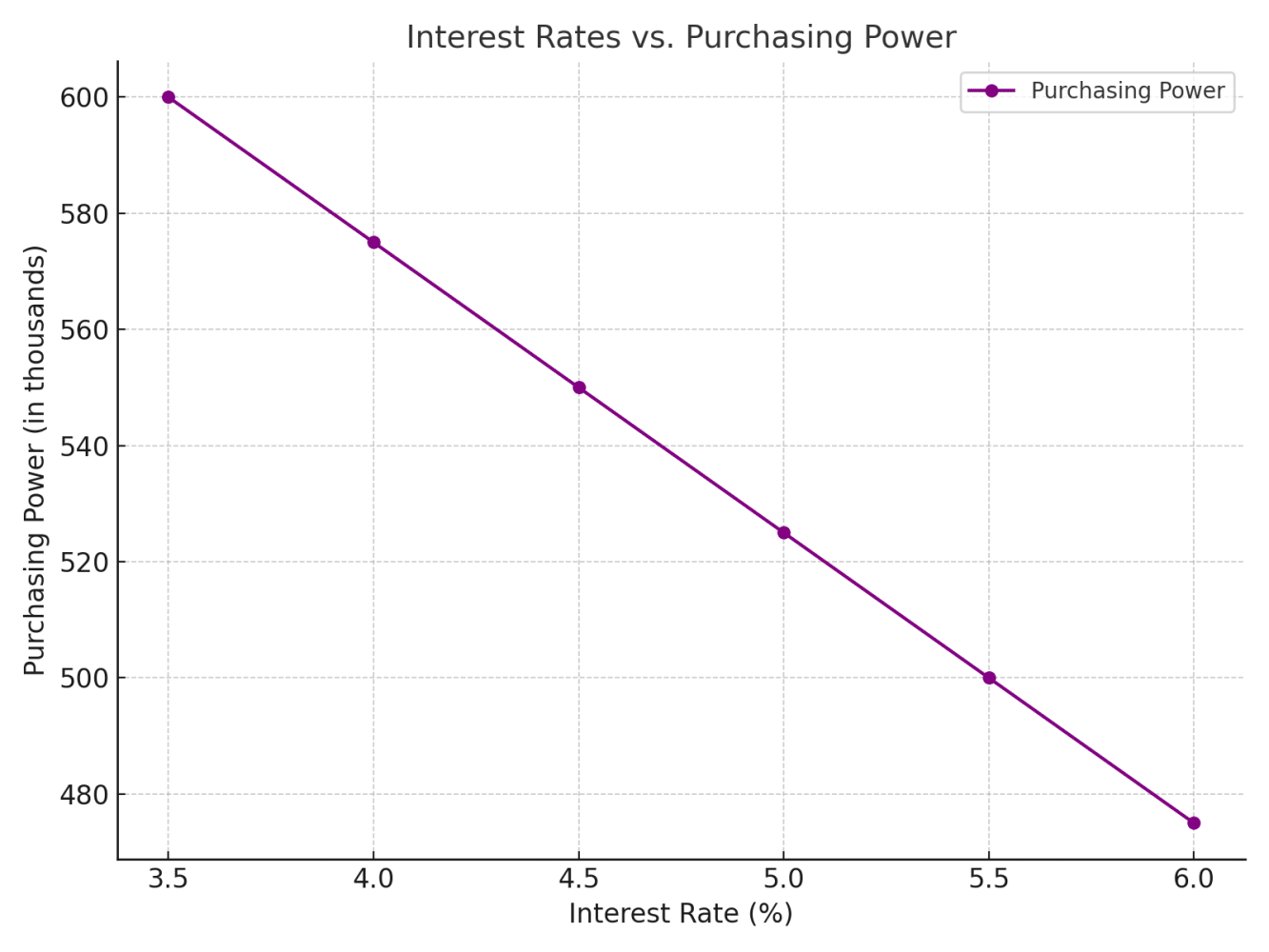

- Affordability: Lower rates increase purchasing power, allowing you to afford a more expensive home or reduce your monthly expenses.

The graph above shows the latest mortgage rates for various loan types in September 2024, helping buyers understand current market conditions.

Economic Factors to Consider

Beyond market trends and rates, consider these economic factors:

- Job Market Stability: A strong job market can give you the confidence to make a long-term investment.

- Inflation Rates: Inflation can affect the cost of living and the value of your investment over time.

Making Your Decision

So, is 2024 a good time to buy a house? It depends on your personal circumstances, financial readiness, and market conditions in your desired area. Here are some steps to help you decide:

- Assess Your Finances: Ensure you have a stable income and sufficient savings for a down payment and closing costs.

- Get Pre-Approved: Speak with a lender to understand how much you can borrow and at what interest rate.

- Consult a Real Estate Professional: An experienced agent can provide local market insights and guide you through the process.

The graph above illustrates how higher interest rates can decrease your purchasing power, helping buyers make informed decisions about when to lock in rates.

Ultimately, staying informed about the housing market trends and economic factors will help you make the best decision for your situation in 2024.

Reach out to us, and we’ll be delighted to assist you. Stay tuned for all updates! Follow us on social media, Facebook, Instagram, and YouTube.

.

.

.

.

Top Charlotte Real Estate Agent As Seen on House Hunters Charlotte guiding her buyer Lyndsay on her relocation.

Charlotte Real Estate Agent

Danielle Edwards

info@soldondanielle.com

704-604-2999