National Housing Market Update: A Mixed Bag of Recovery

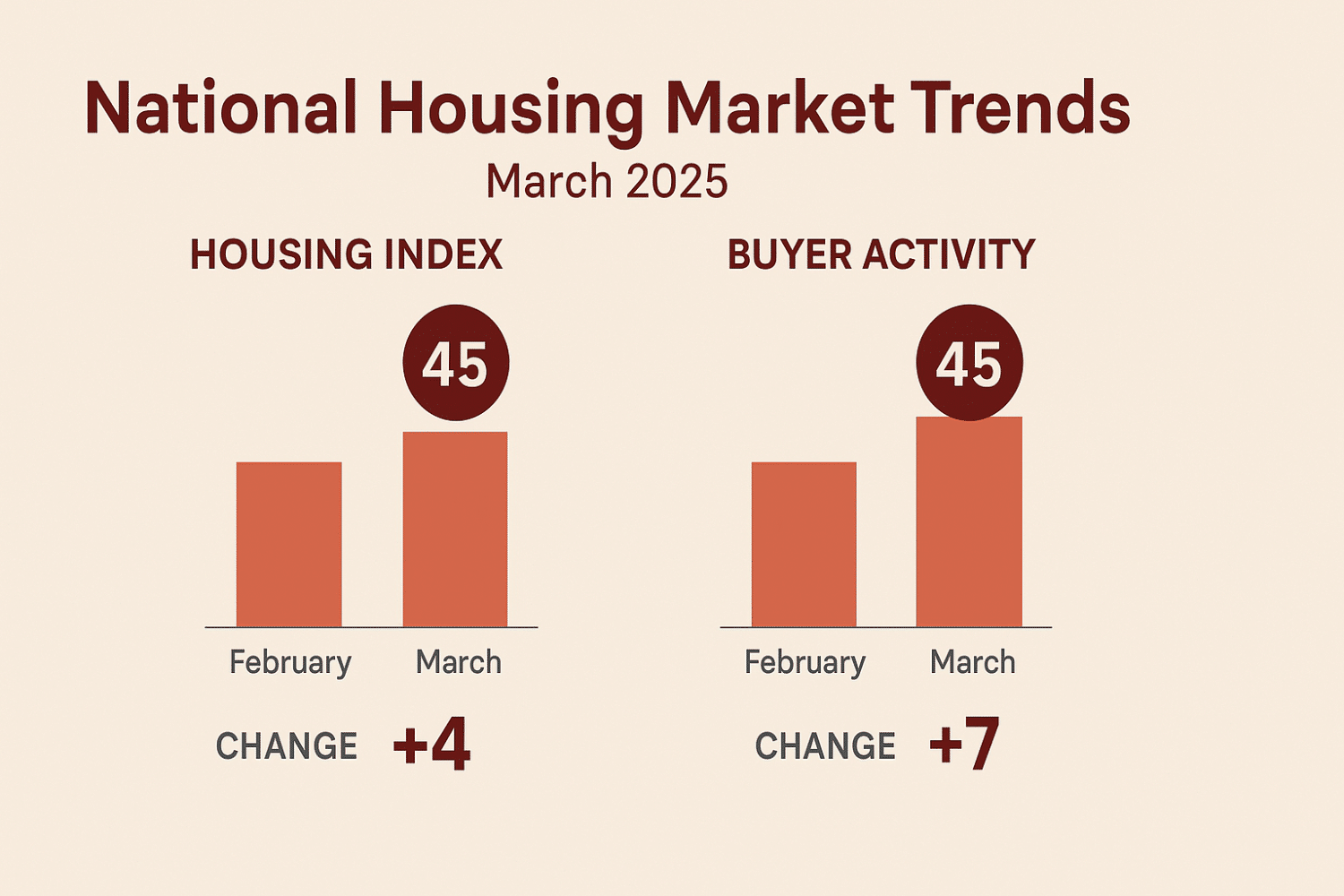

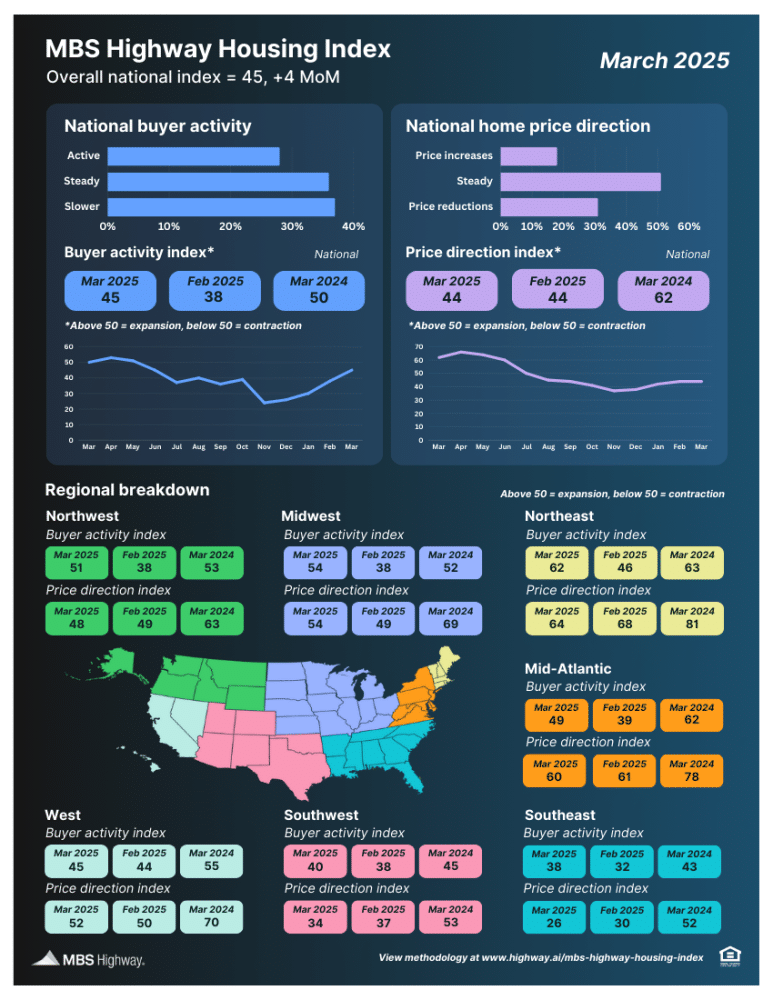

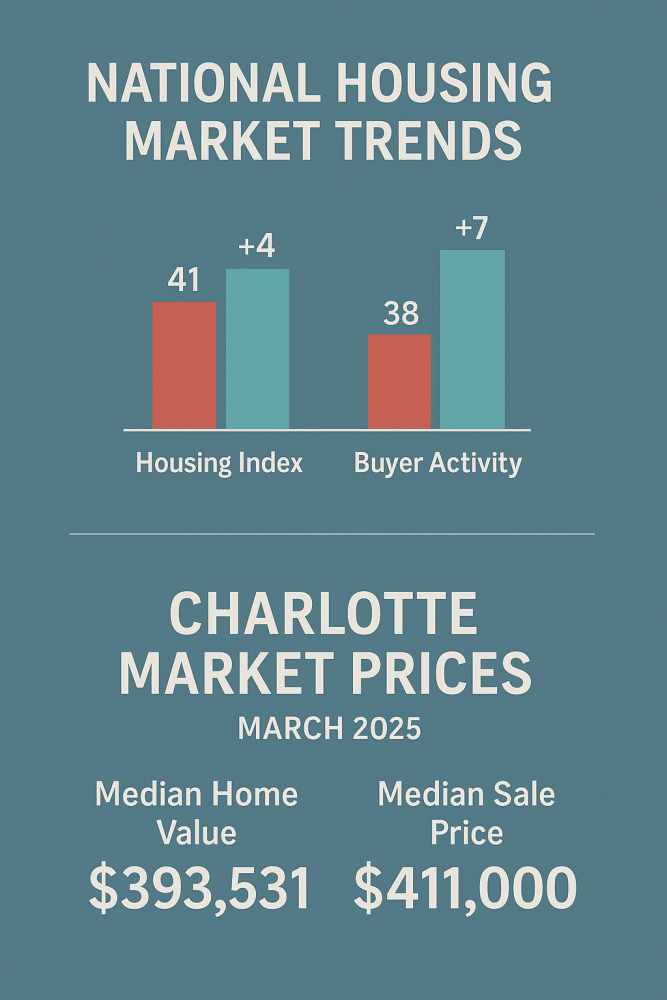

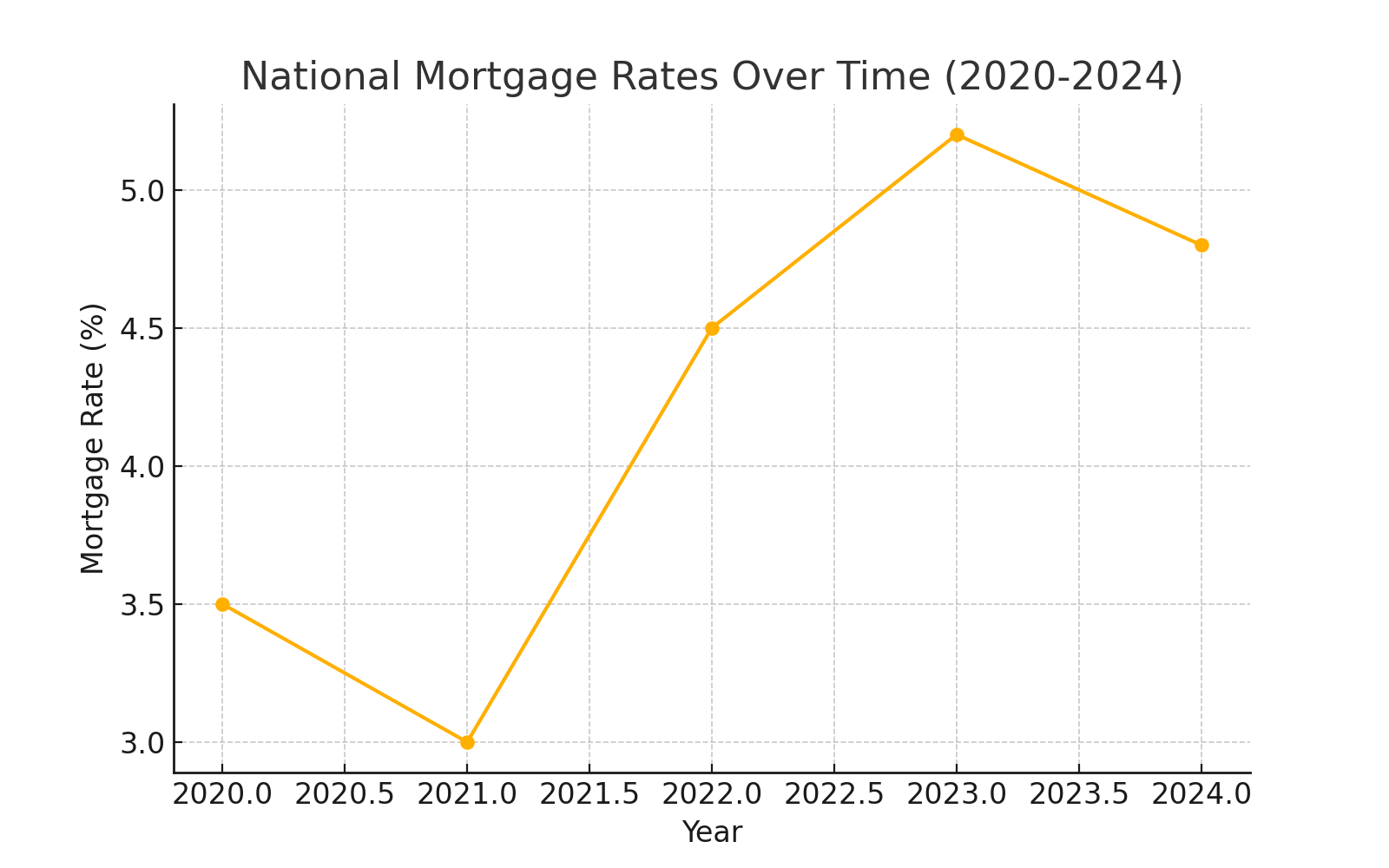

The housing market update for March 2025 reveals a national market trying to gain momentum but still facing headwinds. According to the MBS Highway National Housing Index, the market nudged up 4 points to an index of 45, showing slow improvement but still signaling a contraction (with 50 as the breakeven point).

Buyer activity is showing more life, rising 7 points to hit 45, but price direction has stagnated after three months of moderate gains. While some regions like the Northeast, Midwest, and Northwest show solid increases in activity, the Southeast and Southwest—including parts of North and South Carolina—remain below breakeven, hovering at 38 and 40, respectively.

Charlotte’s Housing Market: Holding Strong in Uncertain Times

While the national outlook is cautious, Charlotte’s real estate market is telling a more stable story. The Queen City continues to hold its ground, offering both buyers and sellers a relatively balanced environment.

Home Values and Pricing Trends

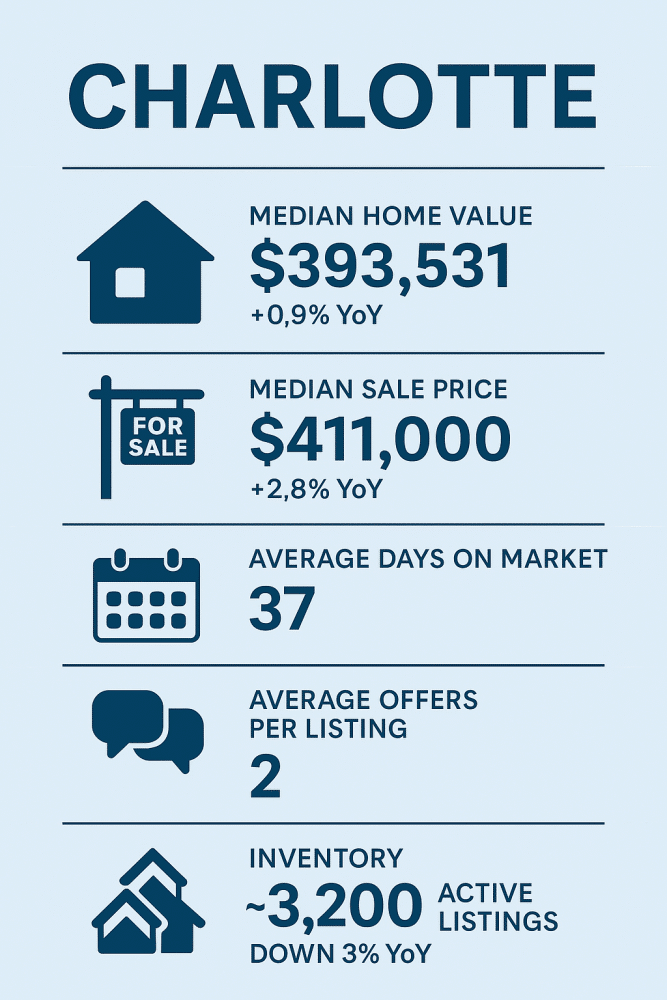

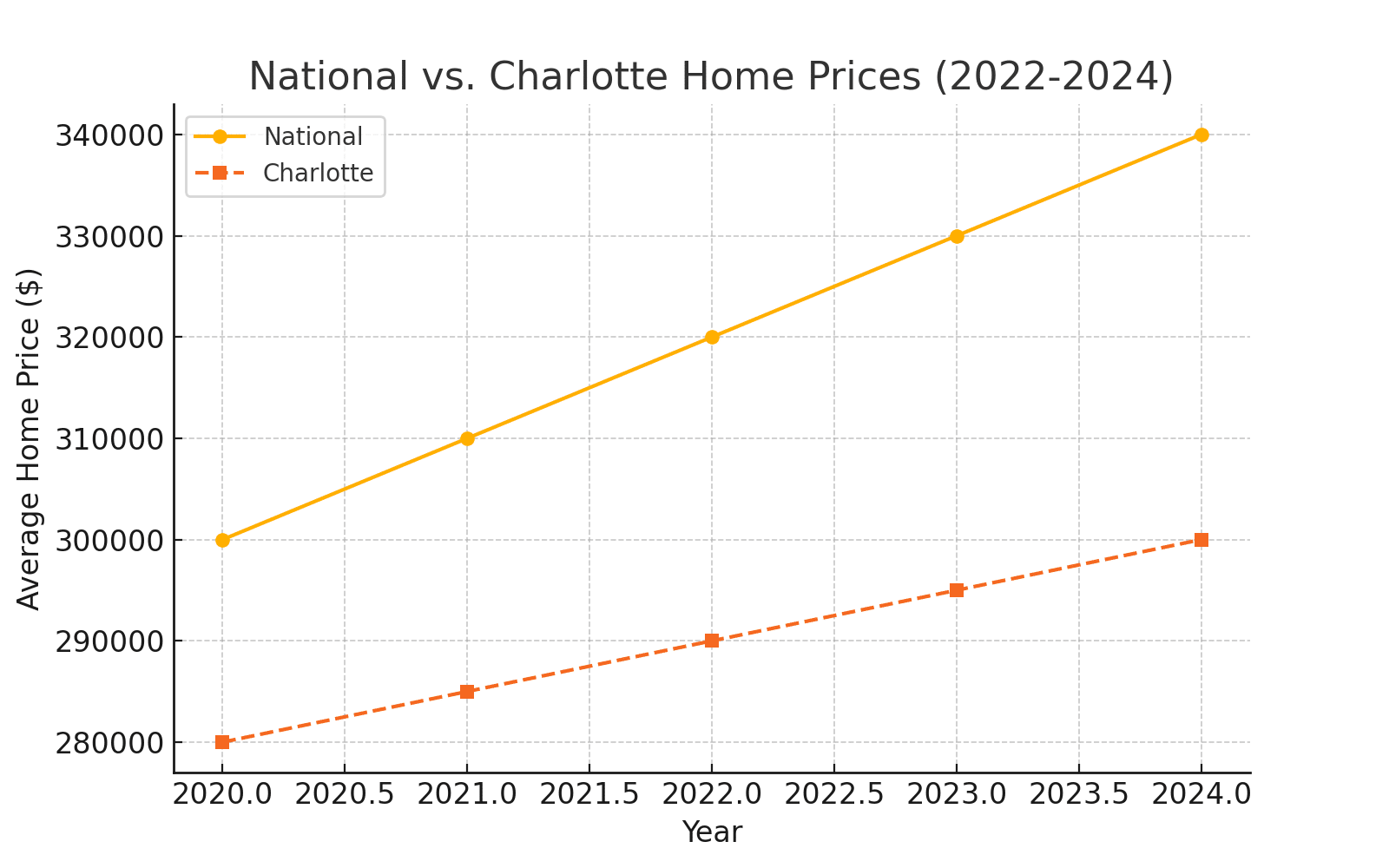

Charlotte’s median home value has climbed to $393,531, a 0.9% year-over-year increase (source: Zillow). Meanwhile, the median sale price sits at $411,000, reflecting a 2.8% uptick compared to March 2024 (Redfin).

Market Activity: Balanced and Competitive, But Manageable

Homes in Charlotte are spending an average of 37 days on the market, and sellers typically receive two offers per listing (Realtor.com). This healthy level of activity indicates a balanced market where neither buyers nor sellers dominate—great news for anyone entering the game in 2025.

Charlotte Market Snapshot: Quick Recap

-

Median Home Value: $393,531 (+0.9% YoY) [Zillow]

-

Median Sale Price: $411,000 [Redfin]

-

Average Days on Market: 37 days [Realtor.com]

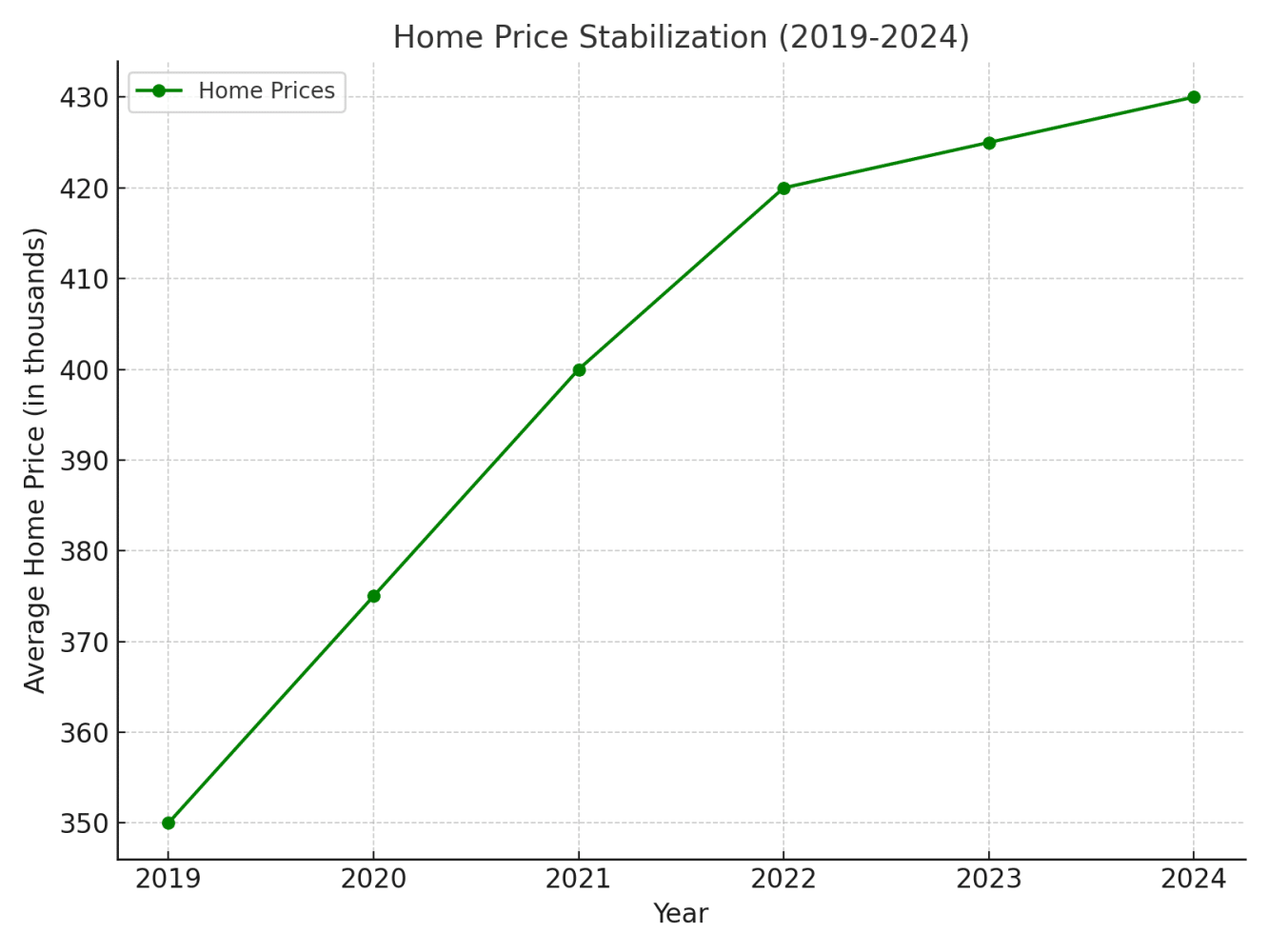

National Pricing vs. Charlotte’s Steady Growth

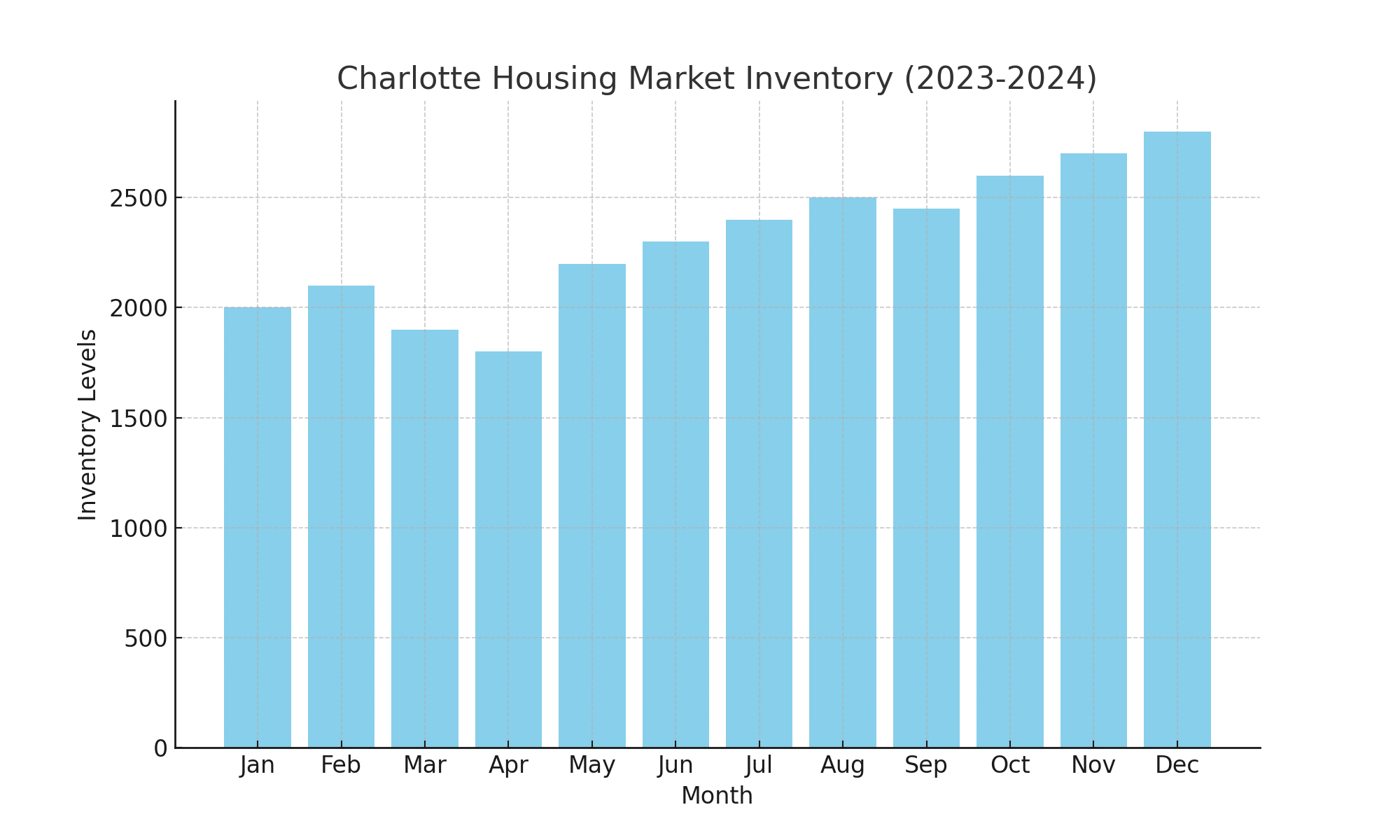

Nationally, price growth has stalled, and some regions are even seeing slight declines. However, Charlotte’s real estate market bucks that trend. Thanks to ongoing local developments like South End’s Queensbridge Collective and Dilworth’s Radius Dilworth apartments, the city maintains steady demand and price appreciation.

Additionally, limited inventory continues to support prices. With only about 3,200 active listings, down 3% from last year (The Luxury Playbook), competition remains healthy but not overwhelming.

Is It a Buyer’s or Seller’s Market? The Answer May Surprise You

Across the U.S., markets vary:

-

Buyer-leaning in parts of Florida, Texas, and the West Coast.

-

Still seller-friendly in the Northeast and Mid-Atlantic.

Charlotte, however, sits comfortably in a balanced zone, making it an ideal time for both buyers and sellers to engage.

Key Takeaways: What You Need to Know

-

National Index: Buyer interest is growing, but pricing remains cautious.

-

Charlotte: A balanced, steady market with mild growth in home values.

-

Price Direction: Stable nationwide but slightly rising in Charlotte.

-

Developments: Local projects like Queensbridge Collective and Radius Dilworth are boosting housing stability.

-

Market Dynamics: Charlotte’s moderate inventory and steady demand foster ongoing stability.

What’s Next for Charlotte’s Real Estate Market?

Looking ahead, Charlotte’s housing market appears poised for continued steady growth through 2025. The city’s blend of new developments, balanced inventory, and healthy demand suggests buyers and sellers can expect consistent opportunities without extreme swings.

Whether you’re buying your first home, looking to upgrade, or considering selling, Charlotte offers a unique advantage—a stable market in a time when others are fluctuating.

Ready to explore your options? Contact me today to navigate Charlotte’s dynamic market with confidence.

.

.

.

.

Top Charlotte Real Estate Agent As Seen on House Hunters Charlotte guiding her buyer Lyndsay on her relocation. info@soldondanielle.com | 704-604-2999 | Charlotte Real Estate Agent | Selling Charlotte since 2006 | Visit my YouTube Testimonials