Dispelling Down Payment Myths for First-Time Homebuyers

Embarking on the journey to purchase your first home can seem overwhelming, particularly when it comes to saving for the various expenses involved, notably the down payment. You might have heard the common belief that you need to set aside 20% of the home’s purchase price for the down payment. However, this isn’t always the case.

Unless stipulated by your loan type or lender, it’s typically not obligatory to provide a 20% down payment. This means you could be closer to achieving your dream of homeownership than you realize.

As stated by The Mortgage Reports:

“While putting down 20% to avoid mortgage insurance is advisable if feasible, it’s a misconception that this is always mandatory. In reality, most individuals opt for a significantly lower down payment.”

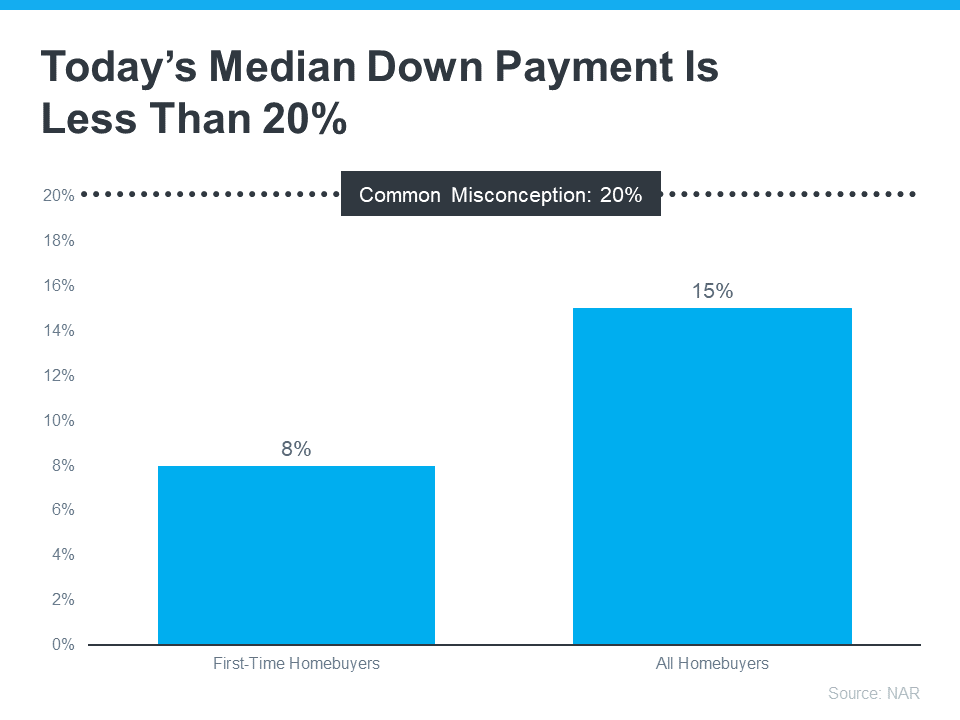

According to data from the National Association of Realtors (NAR), the median down payment hasn’t exceeded 20% since 2005. In fact, for all homebuyers today, it averages only 15%, with first-time buyers typically putting down just 8% (see graph below):

Exploring Available Resources to Aid Your Homebuying Journey

In addition to down payment assistance programs, such as the over 2,000 programs offered across the U.S. according to Down Payment Resource, various loan options can provide support. For instance, FHA loans allow down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for eligible applicants.

To uncover what you qualify for, consult with your loan officer or broker. They are knowledgeable about local grants and loan programs that can assist you.

Don’t let the misconception that a 20% down payment is mandatory hinder your progress toward homeownership. Rely on professionals to help you discover resources that can turn your dreams into reality. Waiting until you’ve saved 20% may actually be more costly in the long term. According to U.S. Bank:

“There are numerous reasons why achieving a 20% down payment might not be feasible. For some, delaying until they’ve saved up 20% may incur too much time. While you’re saving for your down payment and paying rent, the price of your future home may increase.”

Home prices are projected to continue rising over the next 5 years, meaning delaying your purchase could result in a higher purchase price. Leveraging available resources to buy now allows you to benefit from future price appreciation, building equity rather than incurring additional costs.

Check out the journey of a first-time homebuyer as they navigate the real estate market with REMAX agent Danielle Edwards, in the insightful TV show segment.

In Conclusion

Remember, you don’t always require a 20% down payment to purchase a home. If you’re considering making a move this year, let’s connect to initiate discussions about your homeownership goals.

.

.

.

.

.

Top Charlotte Real Estate Agent

Charlotte Real Estate Agent

Danielle Edwards

danielleedwards@REMAX.net

704-604-2999