TAXES YOU NEED TO KEEP IN MIND

Knowing anything is power, I wanted to provide you with this information on the Mecklenburg taxes. I wanted to communicate this to my Realtor partners because that is what my management team sent me.

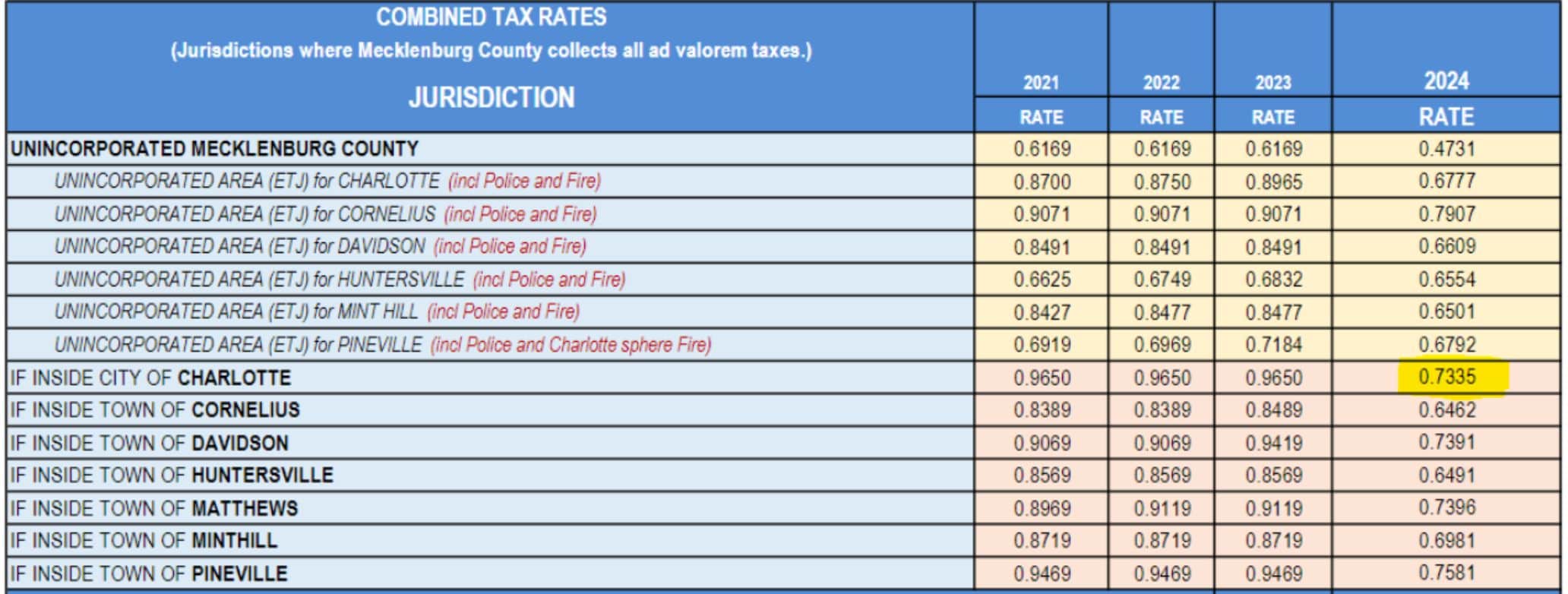

Since Mecklenburg County is mandated to update the assessed values of all properties every four years, they just published their new tax rates. To check the new tax rate for any purchase transactions in Mecklenburg County, you must pull up the tax bill using the link below.

New tax rates here 2023—2024-Tax-Rate-Chart.pdf (widen.net)

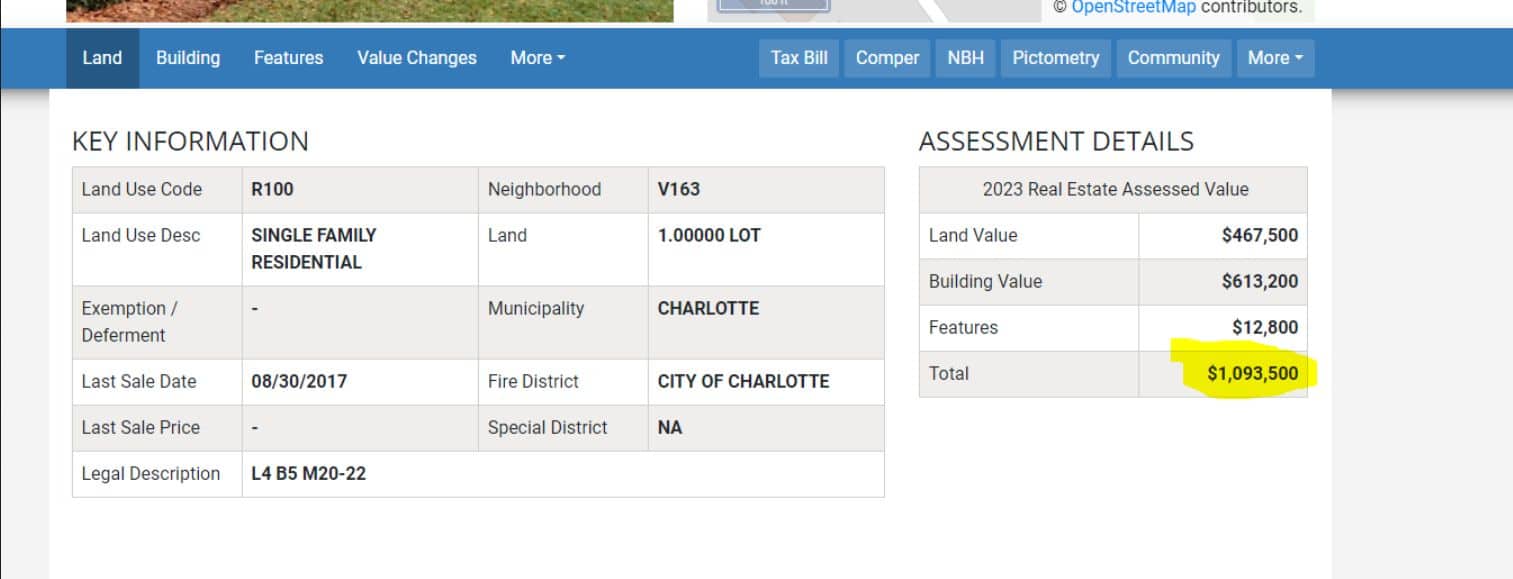

Below is a screenshot of where this can be found.

You then need to figure out which municipality it’s in. For example, the screen shot below is in Charlotte so the new tax rate is .7335. The new assessed value for this property is $1,093,500 so to calculate the taxes, you take $1,093,500, multiply by .007335 to get the annual amount, and then divide by 12 to get the monthly amount that you should put into PCL. So the monthly taxes for this property will be $668.40. You should NOT be looking at the prior year’s tax bill to obtain the property taxes since the new assessed values and tax rates are now out.

Let me know if you have any questions or want to discuss specific situations.

Mecklenburg County tax site here

Contact Danielle Edwards for information on Charlotte, NC, real estate.

Charlotte Realtor® Danielle Edwards has been helping clients with their real estate needs since 2006.

2023 is the year of the Professional Realtor and returning to a more normal real estate market.

Danielle Edwards

Charlotte Real Estate

Realtor, REMAX EXECUTIVE

Hefferon | Edwards Team

704-761-7484

Licensed In: NC

License #: 249833

Contact Me

Useful Links

Check out my FIVE STAR REVIEWS here!