What is the Housing Market Forecast for 2025?

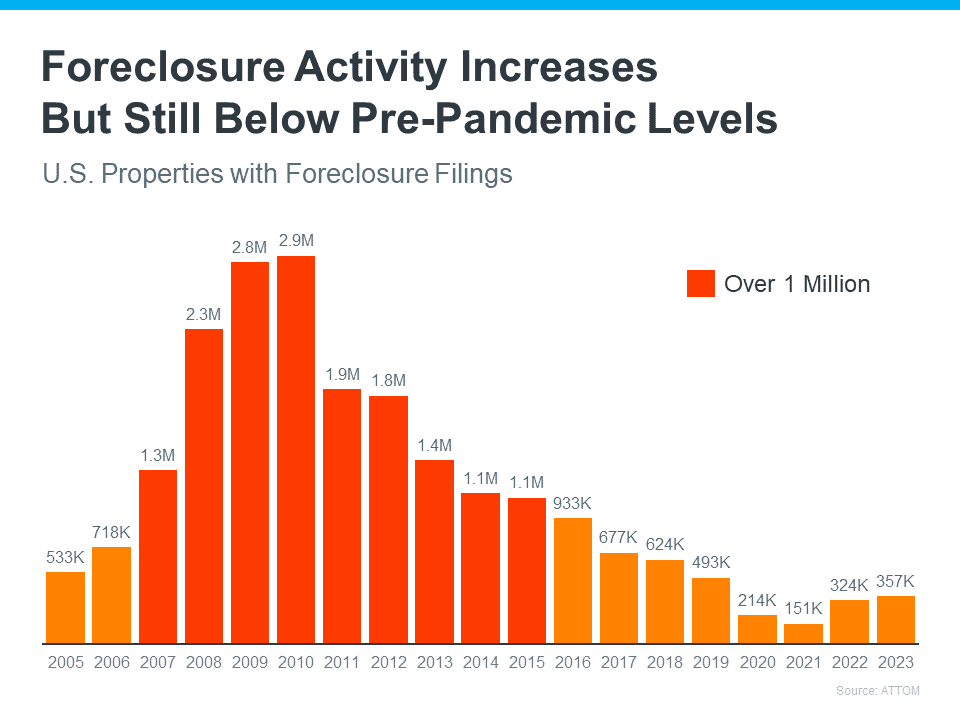

Curious about real estate trends next year? Understanding these trends is essential whether you’re planning to buy, sell, or invest. The housing market forecast for 2025 points to significant shifts in both mortgage rates and home prices. Planning ahead allows you to capitalize on upcoming opportunities. Both buyers and sellers will need to monitor market conditions closely to make the best possible decisions.

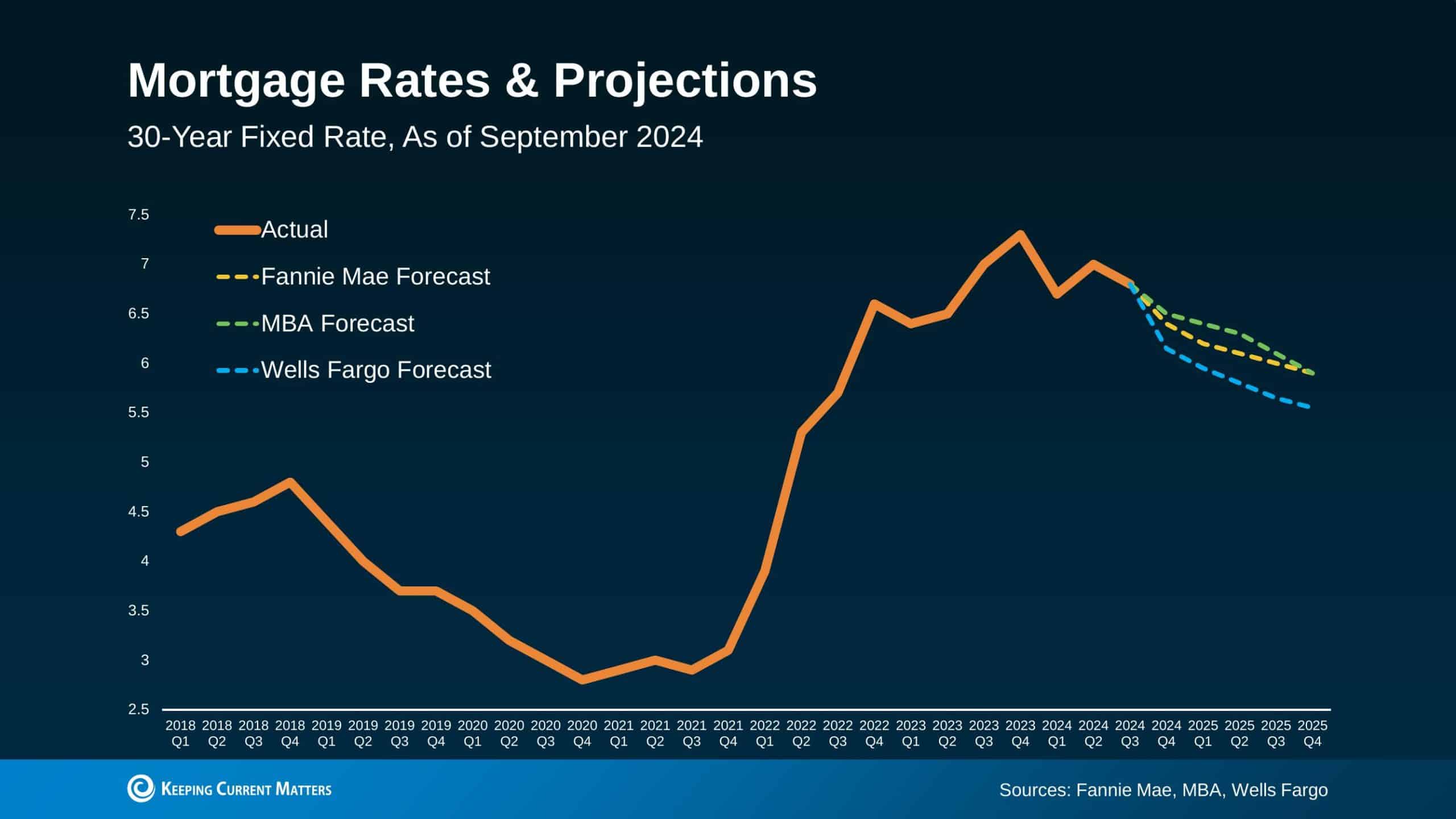

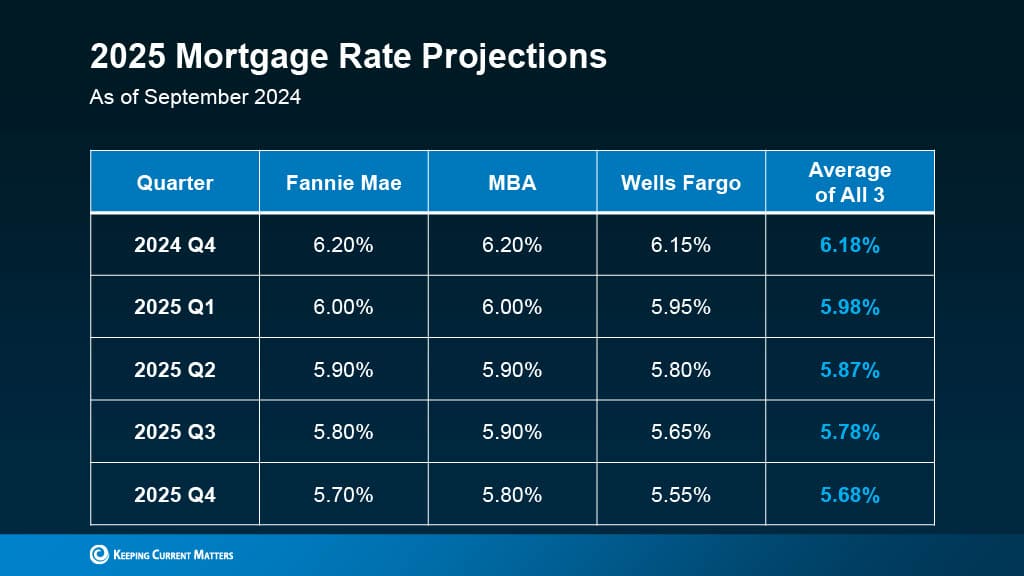

The real estate market is constantly evolving. Key industry players, including Wells Fargo, Fannie Mae, and Goldman Sachs, expect the next year to bring favorable mortgage trends and an uptick in housing prices. The early months of 2025 may offer the best window for buyers to secure low rates before competition rises.

Housing Market Forecast 2025: Key Mortgage Trends to Watch

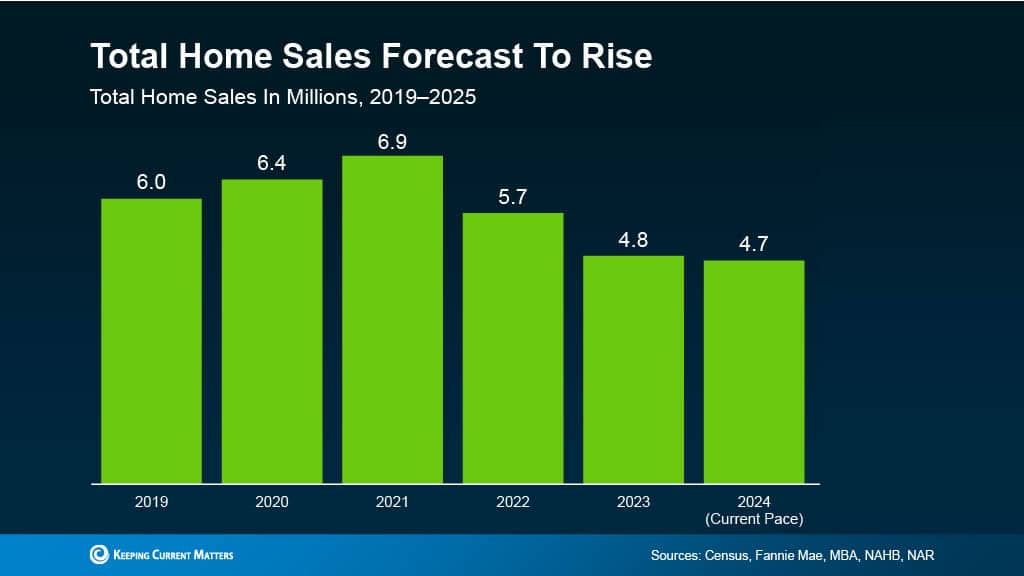

The mortgage trends in 2025 suggest declining rates, providing a favorable environment for buyers. Market analysts predict that mortgage rates could fall steadily through the first half of the year. This drop could result in a surge of buyer activity, as many have been waiting for lower rates to re-enter the market. However, the second half of the year may see increased competition, which could lead to rising home prices.

For sellers, the housing market forecast indicates that listing early in the year may be advantageous. With buyers returning to the market, sellers who prepare and price their homes well will attract serious offers quickly.

Home Prices Forecast for 2025: What Buyers Should Know

The home prices forecast for 2025 highlights expected increases between 2.3% and 4.4%, depending on location and demand. With demand expected to rise as mortgage rates drop, buyers who act sooner can secure homes at lower prices. Waiting could mean facing increased competition and higher prices later in the year.

Sellers, on the other hand, will need to be strategic in pricing their homes. While demand will grow, overpricing could still discourage potential buyers. Staging the home and presenting it well will also help sellers stand out in a competitive market.

Key Market Conditions for Homebuyers and Sellers

- Homes are currently staying on the market for an average of 44 days, giving buyers more time to negotiate better terms.

- Inventory levels have increased from 2 months in October 2023 to 2.4 months in September 2024, offering more options for buyers.

- Over 1,100 price reductions were recorded in September 2024, creating favorable conditions for those looking to make an offer.

Maximizing Market Conditions in 2025

Tracking market conditions for homebuyers and sellers will be crucial in 2025. Buyers can benefit from early action, locking in favorable mortgage rates while inventory is still plentiful. Sellers who list at the right time and price their homes appropriately can expect strong offers as demand rises. Preparing early and partnering with an experienced agent will make all the difference.

Conclusion: Plan for Real Estate Trends Next Year

The real estate trends next year point to opportunities for both buyers and sellers. Early preparation and action will be key to staying ahead in the market. Mortgage rates are expected to decline, but competition will likely increase as more buyers enter the market. Sellers who list and price strategically will benefit from rising demand. Don’t miss your chance—reach out to Danielle Edwards, your trusted RE/MAX agent, and take the next step toward your 2025 real estate goals.

Reach out to us, and we’ll be delighted to assist you. Stay tuned for all updates! Follow us on social media, Facebook, Instagram, and YouTube.

.

.

.

.

Top Charlotte Real Estate Agent As Seen on House Hunters Charlotte guiding her buyer Lyndsay on her relocation.

Charlotte Real Estate Agent

Danielle Edwards

info@soldondanielle.com

704-604-2999