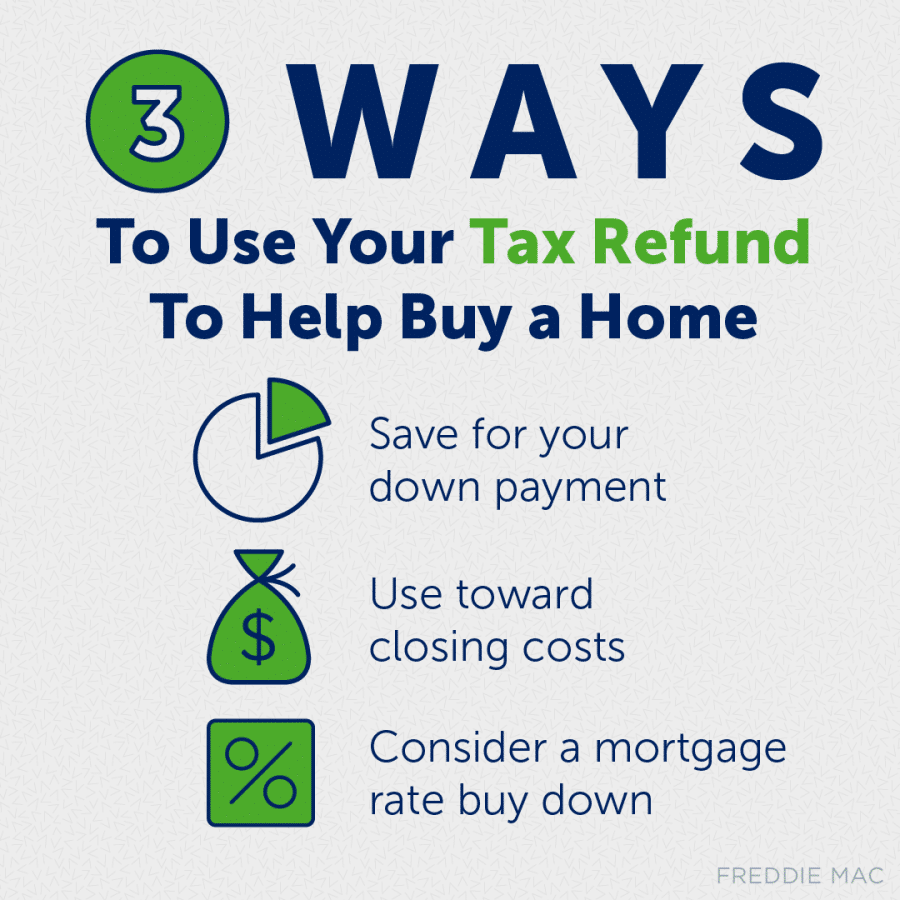

Are you eyeing that dream home but struggling to gather enough funds for a down payment? Your tax refund, specifically earmarked for home purchase, might just be the boost you need to turn that dream into reality. With the average tax refund size showing an increase, now is the perfect time to explore how you can utilize this windfall to pave your way to homeownership.

Saving for a Down Payment

Saving for a down payment is often the most significant hurdle for prospective homebuyers. However, your tax refund can provide a substantial contribution towards this goal. Whether you’re aiming to reach your savings target faster or bolster your existing down payment fund, allocating your tax refund wisely can accelerate your journey towards owning a home.

Paying for Closing Costs

In addition to the down payment, closing costs represent another essential aspect of homebuying. These costs typically range from 2% to 5% of the total purchase price of the home. By directing your tax refund towards covering these expenses, you can alleviate some of the financial burden associated with closing on a property.

Lowering Your Mortgage Rate

Furthermore, your tax refund can be utilized to lower your mortgage rate, thereby enhancing the affordability of homeownership. Many lenders offer the option to buy down your mortgage rate, enabling you to secure a lower interest rate by paying upfront. This can translate into significant long-term savings on your mortgage payments, making homeownership more sustainable in the long run.

Partnering with Real Estate Professionals

Navigating the intricacies of the home-buying process can be daunting, but with the right guidance, you can make informed decisions every step of the way. By partnering with experienced real estate professionals who understand your goals and priorities, you can streamline the homebuying process and ensure that you’re well-prepared to embark on this exciting journey.

Conclusion

Your tax refund presents a valuable opportunity to bolster your savings for buying a home. By leveraging this financial windfall wisely, you can overcome common barriers to homeownership and take significant strides toward securing the home of your dreams. Get in touch with us today to explore how we can help you make the most of your tax refund and turn your homeownership aspirations into reality. Since you are here, watch my video on this subject. Get to know my channel, and share it with those who might need this information.

Reach out to us, and we’ll be delighted to assist you. Stay tuned for all updates! Follow us on social media, Facebook, Instagram, and YouTube.

.

.

.

.

Top Charlotte Real Estate Agent As Seen on House Hunters Charlotte guiding her buyer Lyndsay on her relocation.

Charlotte Real Estate Agent

Danielle Edwards

danielleedwards@REMAX.net

704-604-2999