Why There Won’t Be a Recession That Tanks the Housing Market

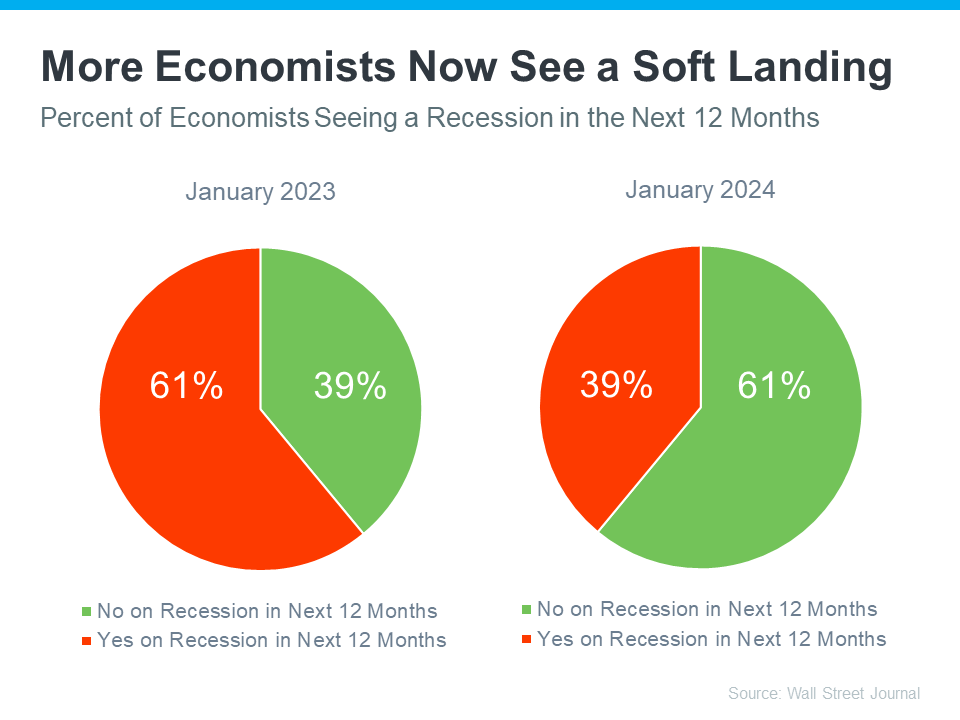

There’s been a lot of recession talk over the past couple of years, leading to concerns of a housing market collapse akin to the 2008 financial crisis. However, expert projections suggest otherwise.

Expert Projections Show Economic Strength

Jacob Channel, Senior Economist at LendingTree, emphasizes the robustness of the economy, stating, “At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.â€

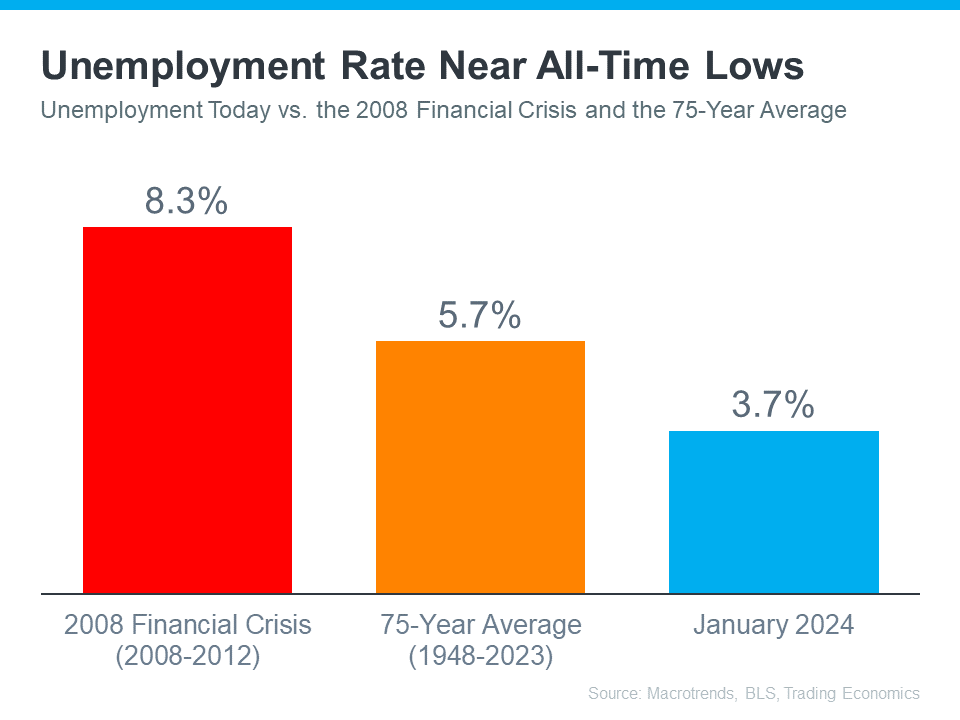

Most experts believe there won’t be a recession in the next 12 months. One reason why is the current unemployment rate. Let’s compare where we are now with historical data from Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics. When we do, it’s clear the unemployment rate today is still very low (see graph below):

The orange bar shows the average unemployment rate since 1948 is about 5.7%. The red bar shows that right after the financial crisis in 2008, when the housing market crashed, the unemployment rate was up to 8.3%. Both of those numbers are much larger than the unemployment rate this January (shown in blue).

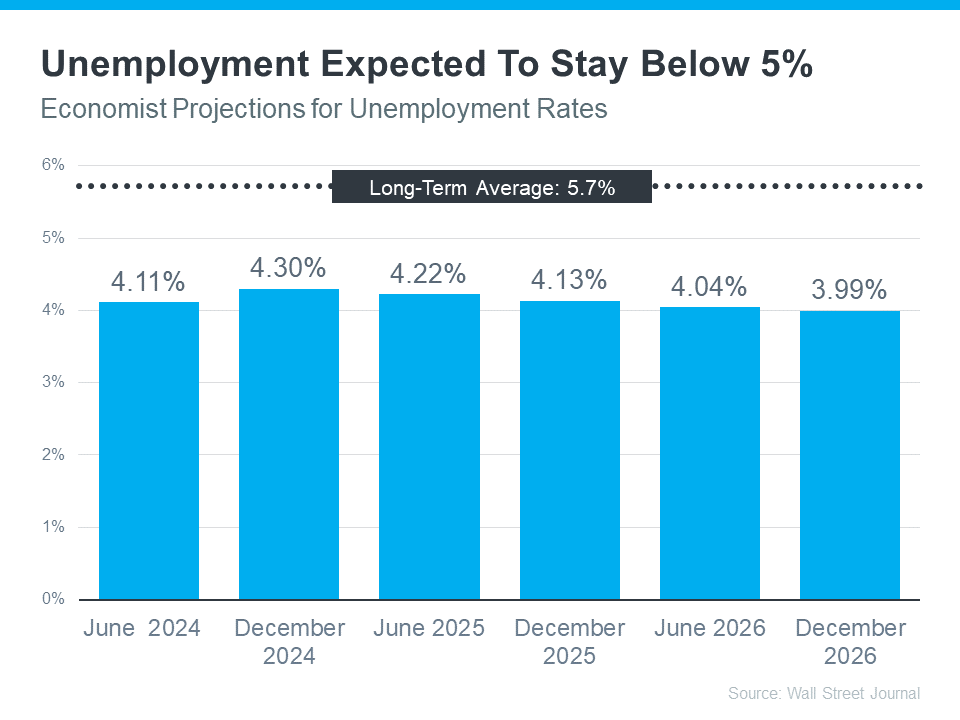

But will the unemployment rate go up? To answer that, look at the graph below. It uses data from that same Wall Street Journal survey to show what the experts are projecting for unemployment over the next three years compared to the long-term average (see graph below):

As you can see, economists don’t expect the unemployment rate to even come close to the long-term average over the next three years – much less the 8.3% we saw when the market last crashed.

Low Unemployment Rates

Most experts now believe that a recession within the next 12 months is unlikely, citing the current low unemployment rate as a significant factor. Historical data comparison reveals that the current unemployment rate remains relatively low compared to past averages and previous crisis periods.

Projected Stability in Unemployment Rates

Future projections also indicate sustained stability in unemployment rates, with economists forecasting rates to remain below historical averages over the next three years. This suggests that the risk of a significant increase in unemployment, which could lead to a wave of foreclosures, is minimal.

Bottom Line: Economic Stability

Experts are increasingly confident that a recession shortly is improbable. With low unemployment rates and projected stability, fears of a housing market crash similar to 2008 are unfounded. This indicates a resilient housing market that is unlikely to experience significant disruptions in the foreseeable future.

Reach out to us, and we’ll be delighted to assist you in finding your dream home. Stay tuned for all updates! Follow us on social media, Facebook, Instagram, and YouTube.

.

.

.

.

Top Charlotte Real Estate Agent As Seen on House Hunters Charlotte guiding her buyer Lyndsay on her relocation.

Charlotte Real Estate Agent

Danielle Edwards

danielleedwards@REMAX.net

704-604-2999