Charlotte Realtor®

Seller’s Market – how to sell your home when you have no place to go.

How to buy a home in a seller’s market without contingencies.

Who would have thought we would ever be here? Yet! Here we are.

Most all homeowner I speak to want to sell their home, but where do they go? It is worth moving to be in a bidding war and then pay top dollar? There are many variables for every homeowner and the options are overwhelming.

Once you check on the traditional ways to make this happen-

- Check with your bank for programs

- Check with your financial advisor for options

- 401k loan with limited penality

- Home equity line

If not of those seem appealing then I can now present you with two new options to hit the market. Welcome the middle man to the Real Estate space, and this is one I don’t mind welcoming.

RIBBON or KNOCK.

They both provide you interesting options worth checking into. Shall I dive in?

They are the cash buyer to purchase your new home. You will have to qualify with a pre approval from your trusted lender and verified the home you are buying and selling meets the qualifications of their program.

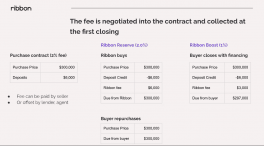

The fee is 2% fee and Ribbon will buy your new home cash and if you are able to secure financing on the close date Ribbon will reduce the fee to 1%.

Then you will pay them a prorated upon rent until your home sells.

This does add additional fees, but for someone who doesn’t want to move twice or make sure they get the house they want, the fees might be worth it.

As a certified Ribbon agent I would first run the home you are purchasing into the system and see if it qualified. The best part about using Ribbon is that it comes with an appraisal guarantee. So, if you are buying a home listed at $349,000 and their analyst say they will offer $359,000, it means you don’t have to worry about appraisal… they are cash buyers.

Then when you buy the home from them either at closing, because your home ended up selling in time or later, that will now be a comparable property to help you secure financing with your lender.

Let’s talk about KNOCK.

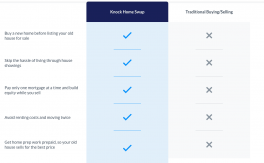

Knock has changed their business model as one that now works side by side with Realtors to help homeowners swap their houses.

Knock offers a unique service to homeowners who are buying their next home. Its Home Swap program allows you to get approved for a mortgage before your old home sells — which most lenders won’t do, due to limits on borrowers’ debt-to-income ratios. Knock can do this because it offers homeowners a backup offer.

Similar to Ribbon they offer you a program to rent the home from them, and if you can’t complete the purchase in 6- month they will buy your old house from you at a pre negotiated amount.

The difference is you have to use KNOCK as your lender.

What does Knock cost?

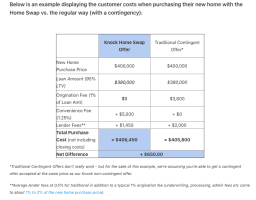

For the Home Swap,they charge a 1.25% convenience fee on the purchase of your new home. This is similar to an origination fee, which many lenders charge.

This chart here shows you a side by side comparison.

Knock will also give you an upfront advance of $25,000 to make any home improvements that will be repaid at closing when your home sells.

They are both similar, but different.

Ribbon you can use your preferred lender.

Knock you use their lender but the fees are less.

Both have a rental fee you pay to them on your old home until the closing occurs and you complete the home swap.

HOW IS THIS DIFFERENT THAN A BRIDGE LOAN?

With a bridge loan, a customer would still have to qualify for two mortgages at once. Bridge loans also have high interest rates, don’t assist with home repairs, and they don’t provide the certainty that comes with the Home Swap.

With the Home Swap, the equity advance is interest free for six months, clients don’t have to qualify for two mortgages – they’ll only be paying the new mortgage while the equity advance covers the old mortgage, and it covers repairs to the old home so the client can put their home on the market to sell for top dollar!

As a Ribbon and Knock certified agent I can walk you through both of these options if traditional creativity is not in the cards.

Check out my Youtube Channel for information on Charlotte real estate and living in Charlotte, NC.

Danielle Edwards

South Charlotte Real Estate

Realtor, REMAX EXECUTIVE

Hefferon | Edward Team

704-761-7484

Licensed In: NC

License #: 249833

Contact Me

Useful Links

What does your equity say?

Buyer Market Update Reports

Danielle Edwards Favorite MUST have Charlotte Real Estate Links

Buyer real estate software for market updates

Best real estate software for your homes value

Search Charlotte Properties with Danielle

Check out my FIVE STAR REVIEWS here!