Foreclosure Numbers: A Comprehensive Comparison with the 2008 Crash

Examining Foreclosure Trends in 2024 Versus the 2008 Housing Crisis

If you’re concerned about recent reports of rising foreclosure numbers in today’s housing market, it’s crucial to understand the context. Let’s delve into how the current situation, including foreclosure numbers, compares to the 2008 crash.

Why the Headlines Are Misleading

Recent headlines may paint a worrisome picture of increasing foreclosures, but the reality isn’t as dire as it seems. Comparing today’s numbers to historic lows during the 2020-2021 moratorium and forbearance programs can skew the perception. It’s crucial to analyze the data comprehensively.

Putting Numbers into Perspective: A Look at the Graph

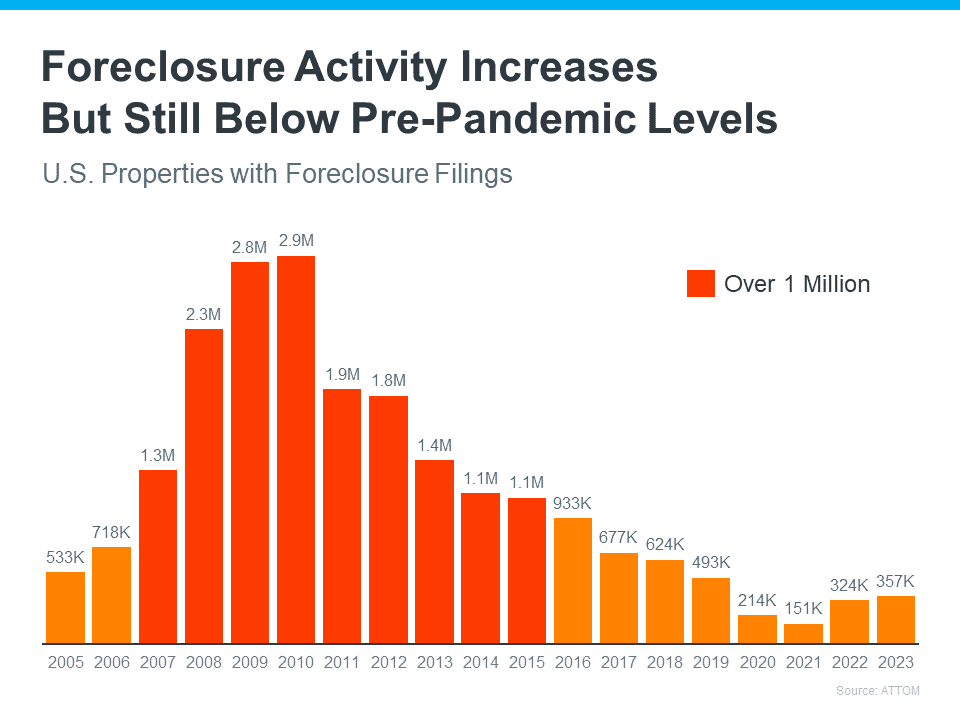

When examining foreclosure activity over the years, it’s evident that the situation today is vastly different from the crisis of 2008. The graph below, utilizing research from ATTOM, a property data provider, illustrates a significant decline in foreclosure filings since the housing crash. The contrast between over 1 million filings per year in the past versus approximately 357,000 in 2023 is striking.

Homeowners’ Equity: A Key Factor

Unlike during the aftermath of the 2008 crash, where millions faced foreclosure and housing prices plummeted, today’s homeowners are in a different position. Most homeowners have built up substantial equity in their properties, acting as a buffer against foreclosure. This equity cushion is a vital safeguard for both homeowners and the overall stability of the housing market.

Dispelling Misconceptions

It’s essential to debunk the misconception that rising foreclosure numbers equate to an impending housing market crash. While there may be an expected uptick in foreclosures as various relief programs end, the situation does not mirror the crisis levels of the past. Understanding the current landscape is crucial for informed decision-making and alleviating concerns about the housing market’s stability.

Conclusion: Stability Amidst Change

In conclusion, while foreclosure numbers may be on the rise, it’s crucial to view them within the broader context of historical data. The current situation differs significantly from the 2008 housing crash, primarily due to homeowners’ improved equity positions. By understanding these nuances, we can navigate the housing market with confidence and dispel fears of an impending crisis.

By analyzing foreclosure numbers in comparison to the 2008 crash, it becomes clear that the housing market is stable and resilient. Let’s continue to monitor trends and make informed decisions to ensure the ongoing health of the housing sector.

Reach out to us, and we’ll be delighted to assist you. Stay tuned for all updates! Follow us on social media, Facebook, Instagram, and YouTube.

.

.

.

.

Top Charlotte Real Estate Agent As Seen on House Hunters Charlotte guiding her buyer Lyndsay on her relocation.

Charlotte Real Estate Agent

Danielle Edwards

danielleedwards@REMAX.net

704-604-2999